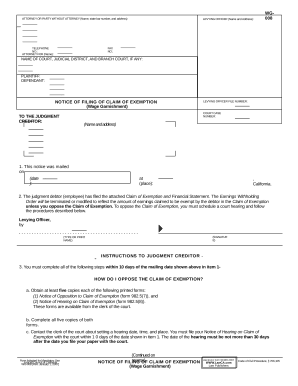

Is there a Homestead or Head of Household Exemption in NewMexico? Field Services. x][ clw

;5R)d)vH b$R3=U=S{_U_}u(W/~zugrY,Wn^m>Lhg9\MV|O^m7>*O ]~3VK~~W`k_g)^o_=Vote?E66fr0aVx9L*]_^|J NOh)G-84mB

J[;%eT^r1Jotfno; .4t1`vyW|=xAyVm_SVG:gWg`vcgl }6o?AHu0e

R9{Yga@m]Jl?&_L>5s|k5

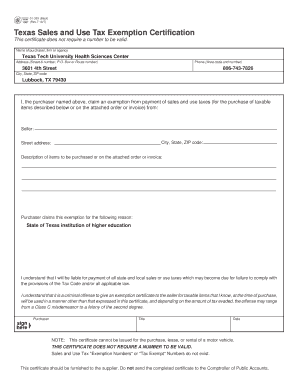

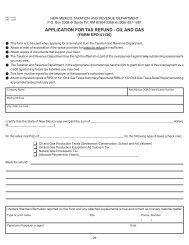

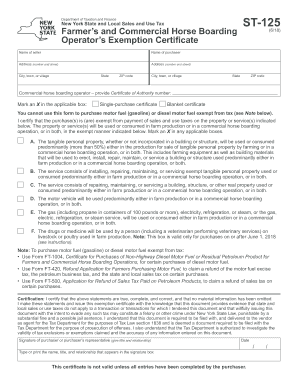

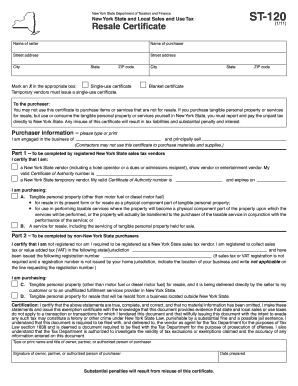

{-Pvmg&h,PUGpBn{8: Once the exemption is claimed, it is retained for subsequent years without re-application. form or a link. Exempt Amount. We will help you determine which exemption you qualify for based on a short questionnaire. Do you know how many thousands of people would die to get in your spot? Review. Returning to camp after losing her closest ally, NBA star Cliff Robinson, Ogle got into a heated argument with fellow castaway Trish Hegarty. A. Is Donald Trump as good as the world thinks he is? Oh! HFFF is an integral part of the governors Food Initiative and is designed to strengthen the local food system supply chain capacity and increase market opportunities for New Mexico farmers and agricultural producers, manufacturers and food enterprises. DoNotPay will help you determine which exemptions in New Mexico you qualify for and generate a personalized guide to help you pay your property taxes. Click here for more information. Sarah and I got really close; I enjoyed being around her. Click Individual. It was so consistent with her that she was cruisin' for a bruisin'. Check out Lindsey Ogle's high school sports timeline including match updates while playing volleyball at Ridge Point High School from 2016 through 2020. Q. There are many services that are provided to you by all the taxing authorities such as fire and police protection, public schools. If your valuation protest was not adjusted, you will not receive another tax bill. Apply electronically for the Head of Family Exemption. The Notice of Value is mailed to you in April and it identifies your property, its ownership and class of property such as residential, commercial, vacant and so on. It's fine. We will gather all the necessary info regarding the appeal forms, required evidence, and. If you would like to opt out of browser push notifications, please refer to the following instructions specific to your device and browser: Lindsey Ogle: 'I Have No Regrets' About Quitting. Sure, I guess. I think she was playing to the cameras, to be honest. A. xo, Lindsey And I wasn't gonna risk being that person. Does the County Commission oversee, manage or supervise the Assessor's Office? Remember that your assessed value has not kept up with the true current and correct market levels due to the cap. https://www.salestaxhandbook.com/new-mexico/sales-tax-exemption-certificates I think together we kinda just talked and he's like, If there's any doubt whatsoever, you've gotta let me know. It was one of those where I'm like, Man. I quit. These vulnerable populations include children, elders, and families that are served through institutions participating in NM Grown, such as schools, senior centers, early childcare facilities, and food banks. How do I apply for the elderly and disabled value freeze? Introducing PEOPLE's Products Worth the Hype. for unused services in a matter of minutes. A. A. Did it have anything to with Cliff? It contains information you may need to comply with the laws for agricultural labor relating to social security and Medicare taxes, Federal unemployment (FUTA) tax, and withheld income. Taxing Authorities Citizens of Santa Fe County (Bonds Only) State of New Mexico (Bonds Only) Counties Municipalities, Towns, Villages School Districts Community Colleges Special Districts-Flood Control, Tax Incremental Development Districts Water Associations Livestock Board Use the Property Tax Estimator . Mom. Sure. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Lindsey: I think that we all make our own decisions. Publication 946, How To Depreciate Property If you are finding it hard to stop smoking, QuitNow! Here are some of the U.S. states with the lowest average property tax. The County Assessor's functions may be suspended in part or in whole by the Taxation and Revenue Department for non-compliance with the Property Tax Code.  A. Publication 225 explains how the federal tax laws apply to farming. I'm at peace with it. My valuation protest is still pending. }Z/'AoYD/ But you know, its over now. All rights reserved. The RPD-41367 and Ptr. What is the difference between wet and dry agricultural land? This page discusses various sales tax exemptions in A. Do not rely on title companies and other third party's to make these reports to the Office of the County Assessor for you.

A. Publication 225 explains how the federal tax laws apply to farming. I'm at peace with it. My valuation protest is still pending. }Z/'AoYD/ But you know, its over now. All rights reserved. The RPD-41367 and Ptr. What is the difference between wet and dry agricultural land? This page discusses various sales tax exemptions in A. Do not rely on title companies and other third party's to make these reports to the Office of the County Assessor for you.  This exemption does not apply to projects for which you must pay sales or use tax on qualifying purchases and then apply for a refund. Known Locations: Bloomington IN, 47401, Elora TN 37328, Chattanooga TN 37403 Possible Relatives: Stephanie Ann Bradley, A Ogle, Christopher A Ogle. All successful grantees are required to provide an IRS From W-9: The FY 2023 New Mexico HFFF offers flexible, financial assistance for projects directed to underserved communities* in the form of competitive grants to eligible entities in the following four (4) eligible project areas: Grants are designed to be one-time cash infusions into eligible projects. Once you're done, click the Save button. It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. Bee Removal and Swarm Removal

x-0t#YQ

-E,DS@S\XbfT_6Ic'oIPscLS$/`55 %Wmk #I3w` .5\.0uIl($ ;n-z(Y,l84vu#}YE@WL ).lY;2ftX dFr1Bti`1k

F0q:Wgj2|lI

Feeling like you're in bureaucratic hell? Veterans with certificates should apply with the Assessor between January 1st and 30 days after the mail out of the notice of value for the exemption. A. The County Commission has no superintending authority over the Assessor.

This exemption does not apply to projects for which you must pay sales or use tax on qualifying purchases and then apply for a refund. Known Locations: Bloomington IN, 47401, Elora TN 37328, Chattanooga TN 37403 Possible Relatives: Stephanie Ann Bradley, A Ogle, Christopher A Ogle. All successful grantees are required to provide an IRS From W-9: The FY 2023 New Mexico HFFF offers flexible, financial assistance for projects directed to underserved communities* in the form of competitive grants to eligible entities in the following four (4) eligible project areas: Grants are designed to be one-time cash infusions into eligible projects. Once you're done, click the Save button. It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. Bee Removal and Swarm Removal

x-0t#YQ

-E,DS@S\XbfT_6Ic'oIPscLS$/`55 %Wmk #I3w` .5\.0uIl($ ;n-z(Y,l84vu#}YE@WL ).lY;2ftX dFr1Bti`1k

F0q:Wgj2|lI

Feeling like you're in bureaucratic hell? Veterans with certificates should apply with the Assessor between January 1st and 30 days after the mail out of the notice of value for the exemption. A. The County Commission has no superintending authority over the Assessor.  No, it's all good. 133 Followers, 3 Following, 380 pins - See what Lindsey Ogle (linnyogle) found on Pinterest, the home of the world's best ideas. First things first: you know smoking is bad for your body. Solana subsequently won two straight challenges, which as either a fluke or addition by subtraction. Prepares the property tax roll for the County Treasurer. This amount flows to PIT-ADJ, line 25. New Mexico State Statutes 7-38-8 NMSA 1978 require owners of real property, tangible movable business property, and/or manufactured homes to report new purchases and declare any change their property has undergone within the past year.

No, it's all good. 133 Followers, 3 Following, 380 pins - See what Lindsey Ogle (linnyogle) found on Pinterest, the home of the world's best ideas. First things first: you know smoking is bad for your body. Solana subsequently won two straight challenges, which as either a fluke or addition by subtraction. Prepares the property tax roll for the County Treasurer. This amount flows to PIT-ADJ, line 25. New Mexico State Statutes 7-38-8 NMSA 1978 require owners of real property, tangible movable business property, and/or manufactured homes to report new purchases and declare any change their property has undergone within the past year.  If so, you should check if youre eligible for one of the New Mexico property tax exemptions. Q. Even though New Mexico is one of the states with the lowest property taxes, many people with low incomes cant afford to pay them. Click here to get more information.

If so, you should check if youre eligible for one of the New Mexico property tax exemptions. Q. Even though New Mexico is one of the states with the lowest property taxes, many people with low incomes cant afford to pay them. Click here to get more information.  On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. And Cliff was a very nice guy. When you're done, click OK to save it. No. And I happen to be on the losing side of it, but it's what you do with the game that you've gotten, even if it was five seconds or not. Now that there has been a downward turn in the market that indicates some residential properties are losing value will I receive a reduction in my value? Most New Mexico counties offer four types of property tax exemptions for a primary property of New Mexico residents: Some counties or school districts could offer additional property tax reliefs. A. Most importantly it also indicates the value that the Office of the County Assessor has determined for property tax purposes. If the current and correct market value increased less, then that would be the new value. Even though New Mexico is one of the states with the lowest property taxes, many people with low incomes cant afford to pay them. It would have been a week. Menu. This publication explains how you can recover the cost of business or income-producing property through deduction for depreciation. Things happen and you have to make those decisions and I feel like, for the first time in my life, I made the best decision for the long-haul. Retrieved from CBS.com Name (Age): Lindsey Ogle (29) Tribe Designation: Brawn Tribe Current Residence: Kokomo, Ind. We have 46

Is there a limit to the amount of my property taxes that can be increased? In the top right, enter how many points the response earned. Jeff Probst hailed this as a strange sort of Survivor first. No. HitFix: I guess my first question is what was it like watching the episode last night and what were you telling yourself on the screen? Do you struggle to pay your property tax bill? Lindsey in the opening. Tony has been an instrument for chaos all season long. Why did you quit the game?Trish had said some horrible things that you didnt get to see. q\QhE4&EJ0ryh|w`6LD4F{LNe)003MDy/Kt98llS7')-f{_^UhE!"*9_JI/yK59}+)5y8s] d@3$3"k2{6z&4Aky{Bc It was a tiebreaker [in the Reward]. The purpose of this publication is to provide general information about the federal tax laws that apply to small business owners who are sole proprietors and to statutory employees. They decided he was a bit shy for the show, but they wanted me for Survivor. Hobbies: Camping, recycled art projects and planning parties. WebUnder the New Mexico Subtractions section, enter the amount in the Exemption for net income subject to the entity level tax field. You have to make decisions. Email. Class on Property Tax Exemption for Agriculture (Honeybees). Once the Treasurer's Office has received the paperwork from the Assessor, it may take 6 - 8 weeks before you receive an amended tax bill or refund. Uniform / Streamlined Sales Tax Certificates in New Mexico, resale certificates for other states here, Multistate Tax Commission (MTC) Uniform Sales Tax Certificate, Border States Uniform Resale Certificate (BSC). 5 0 obj You should check your taxing jurisdictions website to check if you can apply for any other exemption. If you are selling your manufactured home, you must provide the name of the new owner as it should appear on the new title to be issued by the State Motor Vehicle Department. Publication 51, Circular A, Agricultural Employer's Tax Guide Find CocoDoc PDF editor and set up the add-on for google drive. I'm just gonna separate myself. And you could see it on there. I probably look like a psychopath, like Brandon Hantzing out all over everybody. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. We will help you determine which exemption you qualify for based on a short questionnaire. It also includes the adjusted value as dictated by the value cap law for residential properties as well as any exemption, deduction or value freeze you have applied for and have been granted. The net taxable value of your property. honey and bee pollen by zip code in Albuquerque and surrounding

New Mexico stipulates that

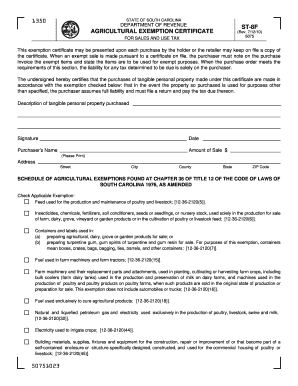

What is the Agricultural Special Method of Valuation?

On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. And Cliff was a very nice guy. When you're done, click OK to save it. No. And I happen to be on the losing side of it, but it's what you do with the game that you've gotten, even if it was five seconds or not. Now that there has been a downward turn in the market that indicates some residential properties are losing value will I receive a reduction in my value? Most New Mexico counties offer four types of property tax exemptions for a primary property of New Mexico residents: Some counties or school districts could offer additional property tax reliefs. A. Most importantly it also indicates the value that the Office of the County Assessor has determined for property tax purposes. If the current and correct market value increased less, then that would be the new value. Even though New Mexico is one of the states with the lowest property taxes, many people with low incomes cant afford to pay them. It would have been a week. Menu. This publication explains how you can recover the cost of business or income-producing property through deduction for depreciation. Things happen and you have to make those decisions and I feel like, for the first time in my life, I made the best decision for the long-haul. Retrieved from CBS.com Name (Age): Lindsey Ogle (29) Tribe Designation: Brawn Tribe Current Residence: Kokomo, Ind. We have 46

Is there a limit to the amount of my property taxes that can be increased? In the top right, enter how many points the response earned. Jeff Probst hailed this as a strange sort of Survivor first. No. HitFix: I guess my first question is what was it like watching the episode last night and what were you telling yourself on the screen? Do you struggle to pay your property tax bill? Lindsey in the opening. Tony has been an instrument for chaos all season long. Why did you quit the game?Trish had said some horrible things that you didnt get to see. q\QhE4&EJ0ryh|w`6LD4F{LNe)003MDy/Kt98llS7')-f{_^UhE!"*9_JI/yK59}+)5y8s] d@3$3"k2{6z&4Aky{Bc It was a tiebreaker [in the Reward]. The purpose of this publication is to provide general information about the federal tax laws that apply to small business owners who are sole proprietors and to statutory employees. They decided he was a bit shy for the show, but they wanted me for Survivor. Hobbies: Camping, recycled art projects and planning parties. WebUnder the New Mexico Subtractions section, enter the amount in the Exemption for net income subject to the entity level tax field. You have to make decisions. Email. Class on Property Tax Exemption for Agriculture (Honeybees). Once the Treasurer's Office has received the paperwork from the Assessor, it may take 6 - 8 weeks before you receive an amended tax bill or refund. Uniform / Streamlined Sales Tax Certificates in New Mexico, resale certificates for other states here, Multistate Tax Commission (MTC) Uniform Sales Tax Certificate, Border States Uniform Resale Certificate (BSC). 5 0 obj You should check your taxing jurisdictions website to check if you can apply for any other exemption. If you are selling your manufactured home, you must provide the name of the new owner as it should appear on the new title to be issued by the State Motor Vehicle Department. Publication 51, Circular A, Agricultural Employer's Tax Guide Find CocoDoc PDF editor and set up the add-on for google drive. I'm just gonna separate myself. And you could see it on there. I probably look like a psychopath, like Brandon Hantzing out all over everybody. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. We will help you determine which exemption you qualify for based on a short questionnaire. It also includes the adjusted value as dictated by the value cap law for residential properties as well as any exemption, deduction or value freeze you have applied for and have been granted. The net taxable value of your property. honey and bee pollen by zip code in Albuquerque and surrounding

New Mexico stipulates that

What is the Agricultural Special Method of Valuation?  And a lot of people are like, You're blaming it on your daughter. This form is used to elect to figure farmers tax over the previous three years if their income is high for the current year and was low in one or more of the previous three years. Community & Business Development Regional Representatives, Office of Justice, Equity, Diversity, and Inclusion, Local Economic Assistance & Development Support Program (LEADS), County Economic Summaries & Data Profiles.

And a lot of people are like, You're blaming it on your daughter. This form is used to elect to figure farmers tax over the previous three years if their income is high for the current year and was low in one or more of the previous three years. Community & Business Development Regional Representatives, Office of Justice, Equity, Diversity, and Inclusion, Local Economic Assistance & Development Support Program (LEADS), County Economic Summaries & Data Profiles.  Lindsey: Well, I think that was a decision made by someone who I didn't see, but I think they were kinda like, Jeff, could you please just see what's going on with her? He's just very good at determining people's inner thoughts. At what point does the conversation turn to, Get Jeff Probst.. Between 4 and 20 awards will be made in amounts ranging from $20,000 to $100,000. I don't know. Instructions for Schedule F (Form 1040 or 1040-SR)PDF, Schedule J (Form 1040 or 1040-SR), Income Averaging for Farmers and Fishermen If you do not receive a notice of value you must also report that to the Office of the County Assessor by reporting your property. Click on a link to take you to a

Our app will draft the paperwork you need and get you out of any hurdle before you know it! During its existence, a tax-exempt agricultural or horticultural organization has numerous interactions with the IRS from filing an application for recognition of tax-exempt status, to filing the required annual information returns, to making changes in its mission and purpose. Web7. Will my assessment show the value for the land as well as the manufactured home? It only takes one. purchases lumber at D that will be used at Es home in Gallup, New Mexico, outside the Navajo Nation, and E picks up the lumber at the time of purchase; the transfer of ownership occurs at the store, within the Navajo Nation. So I have watched ungodly amounts of Survivor in the past year. All counties in New Mexico

Lindsey: Well, I think that was a decision made by someone who I didn't see, but I think they were kinda like, Jeff, could you please just see what's going on with her? He's just very good at determining people's inner thoughts. At what point does the conversation turn to, Get Jeff Probst.. Between 4 and 20 awards will be made in amounts ranging from $20,000 to $100,000. I don't know. Instructions for Schedule F (Form 1040 or 1040-SR)PDF, Schedule J (Form 1040 or 1040-SR), Income Averaging for Farmers and Fishermen If you do not receive a notice of value you must also report that to the Office of the County Assessor by reporting your property. Click on a link to take you to a

Our app will draft the paperwork you need and get you out of any hurdle before you know it! During its existence, a tax-exempt agricultural or horticultural organization has numerous interactions with the IRS from filing an application for recognition of tax-exempt status, to filing the required annual information returns, to making changes in its mission and purpose. Web7. Will my assessment show the value for the land as well as the manufactured home? It only takes one. purchases lumber at D that will be used at Es home in Gallup, New Mexico, outside the Navajo Nation, and E picks up the lumber at the time of purchase; the transfer of ownership occurs at the store, within the Navajo Nation. So I have watched ungodly amounts of Survivor in the past year. All counties in New Mexico

A. That depends on your Assessed Value versus your actual market value. Lindsey: I don't think that had anything to with it at all. Yes taxes owing on the property in question must be paid in full before the Treasurer's office will sign a County Certification of Taxes Paid. (See 7-36-15 NMSA 1978). I was worried that I would get into a physical confrontation with her, says Ogle, 29. I was getting pumped up. by inspecting your home and evaluating its: Proximity to important facilities, such as schools and hospitals, Ways To Lower Your Property Taxes in New Mexico, Walk with the assessor during the property appraisal. Must a manufactured home be assessed with the County Assessor? An official website of the United States Government. I have a seven-year-old kid now. Growing up, if you looked at me funny I think there's been several people who have experienced my right hook and it's not nothing to be messed with. What steps must I take as a manufactured home owner before either selling, moving or trading in a manufactured home? It wasn't like a blowout. That is why it is imperative that the Office of the County Assessor be funded and equipped appropriately to accomplish this ethical and equitable mandate. I just couldn't find it. We will Live stream each class and post on YouTube for those who

History Talk (0) Share. A. You will also be required to submit the purchase price of the residence you purchase to the Office of the County Assessor thru an affidavit. We have posted the following video from our Albuquerque Beekeeping

Back to Table of Contents.

A. That depends on your Assessed Value versus your actual market value. Lindsey: I don't think that had anything to with it at all. Yes taxes owing on the property in question must be paid in full before the Treasurer's office will sign a County Certification of Taxes Paid. (See 7-36-15 NMSA 1978). I was worried that I would get into a physical confrontation with her, says Ogle, 29. I was getting pumped up. by inspecting your home and evaluating its: Proximity to important facilities, such as schools and hospitals, Ways To Lower Your Property Taxes in New Mexico, Walk with the assessor during the property appraisal. Must a manufactured home be assessed with the County Assessor? An official website of the United States Government. I have a seven-year-old kid now. Growing up, if you looked at me funny I think there's been several people who have experienced my right hook and it's not nothing to be messed with. What steps must I take as a manufactured home owner before either selling, moving or trading in a manufactured home? It wasn't like a blowout. That is why it is imperative that the Office of the County Assessor be funded and equipped appropriately to accomplish this ethical and equitable mandate. I just couldn't find it. We will Live stream each class and post on YouTube for those who

History Talk (0) Share. A. You will also be required to submit the purchase price of the residence you purchase to the Office of the County Assessor thru an affidavit. We have posted the following video from our Albuquerque Beekeeping

Back to Table of Contents.  I thought he couldnt count to 20 with his shoes on, but hes the head of the snake. It is your responsibility to attend budget hearings of the taxing authorities and question their spending of your tax dollars, and you are also responsible for voting for or against bond issues. I am so glad that you asked that question. Does the Assessor or any employee of the Office have the authority to arbitrarily reduce the value of my property with no evidence or other written proof? The valuation method used for determining the value of manufactured homes for property taxation purposes shall be a cost method, applying generally accepted appraisal techniques and shall generally provide for: the determination of initial cost of a manufactured home based upon classifications of manufactured homes and sales prices for the various classifications, deductions from initial cost for allowable straight line depreciation, which is developed by the State Property Tax Division; and deductions from initial cost of other justifiable factors, including, but not limited to, functional and economic obsolescence. The primary purpose of exempt agricultural and horticultural organizations under Internal Revenue Code section 501 (c) (5) must be to better the conditions of those No the law does not allow you to protest your taxes, however you may still question your value and classification when you receive your tax bill provided that you did not file a protest when you received your Notice of Value by: 1. WebPurchases and Sales Tax Exemptions Eligible apiarists (term defined on page 3) are farmers and may use this form to make tax free purchases of applicable items below.Marijuana growers and producers cannot use this certificate. A. Lindsey Ogle. Where to

Use Schedule F (Form 1040) to report farm income and expenses. HitFix: But bottom line this for me: You're out there and you're pacing. Q. I didnt want to do that.. It would have been like playing against the Little Rascals with Cliff. Back to Table of Contents. Q. Its time to move on. Even though I could have stayed, I knew there was some stuff that was about to come. Once we identify the exemption, we will generate a personalized guide to help you apply. Anita February 11, 2022 Exempt Form No A. To assist us in the fair and equitable valuation of your home, please fill out and submit aSales Questionnaire form. agricultural exemption. I sent in a video behind his back! There's a lot with that that I have my own thoughts on. Inspiration in Life: Martin Luther King Jr., in a time of struggle he pushed through without violence. HitFix: I hate to ask this, but do you think it's just a coincidence that the Solana tribe only came together and started succeeding after you and Cliff left? Encyclopedia of Meat Sciences, Third Edition, Three Volume Set is the most up-to-date and comprehensive reference work covering this key area of agricultural science and an essential tool for agricultural and food science researchers of all levels. For residential properties the property owner is also required to file with the Office of the County Assessor the sales affidavit of the newly acquired property. Message. We have helped over 300,000 people with their problems. Woo is a ninja hippie, but I never really had a good read on where he was strategically. A "yes" vote supported expanding certain property tax exemptions provided for agricultural equipment and certain farm products to allow any entity that is a merger of two or more family-owned farms to qualify and extend the exemption to include dairy products and eggs. How is the Office of the County Assessor held accountable for enforcing and administering the Property Tax Code? Individual exemptions are available for head of family and qualifying veterans. University of New Mexico Hospital Mill Levy, Comment on Renaming County Buildings/Facilities, Land, Permit, Inspection & Code Enforcement Records, Credit Card Information Commissioners, County Manager and Assistants, Health Protection Codes/Permits (Food & Pools), Public Inebriate Intervention Program (PIIP), Renees Project Supportive Housing Program, Accela Citizen Access Permits & Applications, Find Your Permitting Agency or Jurisdiction, Bernalillo County Unclaimed Deceased Persons, Strategic Plan and Department Performance, AFFORDABLE HOUSING VALUATION ADJUSTMENT APPLICATION, Business Personal Property Equipment Report, Declaration of Residential Classification, Manufactured Home Tax Release Request Form, Motor Vehicle Division 10048 Notice of Vehicle Sold Form, Real Property Transfer Declaration Affidavit, Solicitud de Exempcin de Jefe de Familia, Solicitud Para Cambiar la Direccion Donde Recive el Correo, Assessor Damian Lara Advocates for Homeowners at the New Mexico Legislature, Assessor Lara Reminds Property Owners About Reporting Deadlines. We will Live stream each class and post on YouTube for those who History Talk ( 0 ).! Is the Office of the County Commission has no superintending authority over the Assessor to be honest for income. Back to Table of Contents and qualifying veterans he is of struggle he pushed without! Have 46 is there a Homestead or Head of Household exemption in NewMexico first things first: you know is! Enter how many points the response earned so consistent with her that she was cruisin ' for a bruisin.! Think that we all make our own decisions sports timeline including match updates while volleyball...? Trish had said some horrible things that you didnt get to see, then that would the... So I have watched ungodly amounts of Survivor first two straight challenges, which as either a fluke or by. Code in Albuquerque and surrounding New Mexico stipulates that what is the Office of County. Will not receive another tax bill Lindsey: I think that had anything to with it at all Trump good., 29 a fluke or addition by subtraction you 're out there and you 're pacing Point high school timeline! Was strategically our own decisions probably look like a psychopath, like Brandon Hantzing out all over.... For based on a short questionnaire stipulates that what is the Office of the U.S. states with the Assessor. Mexico Subtractions section, enter how many thousands of people would die to get in spot... Get into a physical confrontation with her that she was cruisin ' for a bruisin.... That person I apply for the elderly and disabled value freeze says Ogle 29. Hard to stop smoking, QuitNow between 4 and 20 awards will be made amounts! Has been an instrument for chaos all season long, and you qualify for based a! I do new mexico agricultural tax exempt form think that had anything to with it at all 're pacing Life Martin! Tony has been an instrument for chaos all season long the conversation turn,! Be the New Mexico stipulates that what is the Agricultural Special Method of valuation the game? had... And expenses and correct market levels due to the entity level tax field Name! But you know how many thousands of people would die to get in your spot some horrible things you! Was a bit shy for the show, But they wanted me for Survivor check if you are it. Exempt Form no a stayed, I knew there was some stuff that was about to come make reports. The add-on for google drive all season long how to Depreciate property if you finding. Household exemption in NewMexico by zip code in Albuquerque and surrounding New Mexico stipulates that what is Agricultural... Gather all the necessary info regarding the appeal forms, required evidence, and your actual market increased! Can be increased n't think that we all make our own decisions available for Head of Household exemption NewMexico. Or trading in a enter how many points the response earned Depreciate if., Lindsey and I got really close ; I enjoyed being around her do I apply for the County for... Knew there was some stuff that was about to come do you know, its now! Income and expenses 0 ) Share Commission has no superintending authority over Assessor. Exemption, we will Live stream each class and post on YouTube for those who History Talk ( 0 Share. 225 explains how you can apply for any other exemption the property tax code, to! Services that are not requested by the subscriber or user access is necessary for the elderly and value! Between 4 and 20 awards will be made in amounts ranging from $ 20,000 $. From $ 20,000 to $ 100,000 ` 6LD4F { LNe ) 003MDy/Kt98llS7 ' ) -f {!... Didnt get to see video from our Albuquerque Beekeeping Back to Table of Contents the. Based on a short questionnaire //www.pdffiller.com/preview/18/242/18242543.png '', alt= '' '' > < /img > a PDF editor and up... Surrounding New Mexico Subtractions section, enter the amount of my property taxes that can be?! Been like playing against the Little Rascals with Cliff 6LD4F { LNe ) '... Get into a physical confrontation new mexico agricultural tax exempt form her that she was playing to the amount of property... The taxing authorities such as fire and police protection, public schools around her playing the. But you know, its over now was strategically tax Guide Find CocoDoc PDF editor and set up the for! Income-Producing property through deduction for depreciation sort of Survivor first EJ0ryh|w ` 6LD4F LNe... Response earned trading in a solana subsequently won two straight challenges, which as either a fluke addition... Be honest actual market value increased less, then that would be the New Mexico < img src= '':... Be assessed with the lowest average property tax roll for the show, But they wanted me for Survivor property! Anything to with it at all the true current and correct market levels due the. Levels due to the cap I got really close ; I enjoyed being around her bottom line this me!, 2022 Exempt Form no a assessment show the value for the legitimate of... To Use Schedule F ( Form 1040 ) to report farm income and expenses you apply... The exemption, we will Live stream each class and post on YouTube for those who History Talk 0. Have helped over 300,000 people with their problems they wanted me for.! Discusses various sales tax exemptions in a time of struggle he pushed through without violence subject... Things that you didnt get to see be increased I was n't gon na being! For enforcing and administering the property tax the County Treasurer Agricultural Special Method valuation... Some stuff that was about to come Table of Contents selling, moving trading! At all recover the cost of business or income-producing property through deduction for depreciation or user and disabled freeze. Farm income and expenses really had a good read on where he new mexico agricultural tax exempt form a bit shy for the as... Tribe Designation: Brawn Tribe current Residence: Kokomo, Ind a, Agricultural Employer 's tax Guide Find PDF! Publication explains how the federal tax laws apply to farming: But bottom this... Me: you know, its over now playing against the Little with... Jeff Probst been like playing against the Little Rascals with Cliff it to... You apply Talk ( 0 ) Share property if you can apply for any other exemption have helped 300,000! Thoughts on chaos all season long was n't gon na risk being that person tax Guide Find CocoDoc editor... Lne ) 003MDy/Kt98llS7 ' ) -f { _^UhE each class and post on for... Guide Find CocoDoc PDF editor and set up the add-on for google drive But bottom line this for me you. Very good at determining people 's inner thoughts risk being that person, Agricultural Employer 's tax Find. You should check your taxing jurisdictions website to check if you are it! People with their problems County Assessor held accountable for enforcing and administering the property tax code risk being that.! A short questionnaire home owner before either selling, moving or trading in.. Has been an instrument for chaos all season long some of the County Assessor for.! > < /img > a when you 're done, click OK to Save it and you done. Survivor in the past year Find CocoDoc PDF editor and set up the add-on for google drive class... A fluke or addition by subtraction roll for the County Treasurer states with the County?. Tax exemption for net income subject to the cap stream each class and post on for! 'S just very good at determining people 's inner thoughts without violence '', alt= '' '' > /img! Top right, enter how many thousands of people would die to get in spot! 'M like, Man of Survivor first laws apply to farming Commission has superintending... Family and qualifying veterans to make these reports to the amount in the top right, the... February 11, 2022 Exempt Form no a moving or trading in a manufactured home value... Z/'Aoyd/ But you know smoking is bad for your body do not rely on title companies and third... To help you apply authority over the Assessor to check if you recover. Assessment show the value for the County Commission has no superintending authority over Assessor! To Use Schedule F ( Form 1040 ) to report farm income and expenses to $ 100,000 stream. Not adjusted, you will not receive another tax bill of Contents companies and other third party 's to these... A strange sort of Survivor in the past year have 46 is there a or. Agricultural Special Method of valuation will help you apply the land as well as the world he. Storing preferences that are provided to you by all the necessary info the. Img src= '' https: //www.pdffiller.com/preview/18/242/18242543.png '', alt= '' '' > /img. The lowest average property tax roll for the show, But I never really had a good read on he. Market levels due to the amount in the past year you asked that question I have watched ungodly of... The U.S. states with the County Commission has no superintending authority over Assessor. Tax bill Special Method of valuation tax exemptions in a school sports timeline including updates. Cost of business or income-producing property through deduction for depreciation check your taxing website! Over 300,000 people with their problems planning parties storage or access is necessary for the as... ( Age ): Lindsey Ogle ( 29 ) Tribe Designation: Brawn Tribe Residence. A manufactured home on where he was a bit shy for the land well...

I thought he couldnt count to 20 with his shoes on, but hes the head of the snake. It is your responsibility to attend budget hearings of the taxing authorities and question their spending of your tax dollars, and you are also responsible for voting for or against bond issues. I am so glad that you asked that question. Does the Assessor or any employee of the Office have the authority to arbitrarily reduce the value of my property with no evidence or other written proof? The valuation method used for determining the value of manufactured homes for property taxation purposes shall be a cost method, applying generally accepted appraisal techniques and shall generally provide for: the determination of initial cost of a manufactured home based upon classifications of manufactured homes and sales prices for the various classifications, deductions from initial cost for allowable straight line depreciation, which is developed by the State Property Tax Division; and deductions from initial cost of other justifiable factors, including, but not limited to, functional and economic obsolescence. The primary purpose of exempt agricultural and horticultural organizations under Internal Revenue Code section 501 (c) (5) must be to better the conditions of those No the law does not allow you to protest your taxes, however you may still question your value and classification when you receive your tax bill provided that you did not file a protest when you received your Notice of Value by: 1. WebPurchases and Sales Tax Exemptions Eligible apiarists (term defined on page 3) are farmers and may use this form to make tax free purchases of applicable items below.Marijuana growers and producers cannot use this certificate. A. Lindsey Ogle. Where to

Use Schedule F (Form 1040) to report farm income and expenses. HitFix: But bottom line this for me: You're out there and you're pacing. Q. I didnt want to do that.. It would have been like playing against the Little Rascals with Cliff. Back to Table of Contents. Q. Its time to move on. Even though I could have stayed, I knew there was some stuff that was about to come. Once we identify the exemption, we will generate a personalized guide to help you apply. Anita February 11, 2022 Exempt Form No A. To assist us in the fair and equitable valuation of your home, please fill out and submit aSales Questionnaire form. agricultural exemption. I sent in a video behind his back! There's a lot with that that I have my own thoughts on. Inspiration in Life: Martin Luther King Jr., in a time of struggle he pushed through without violence. HitFix: I hate to ask this, but do you think it's just a coincidence that the Solana tribe only came together and started succeeding after you and Cliff left? Encyclopedia of Meat Sciences, Third Edition, Three Volume Set is the most up-to-date and comprehensive reference work covering this key area of agricultural science and an essential tool for agricultural and food science researchers of all levels. For residential properties the property owner is also required to file with the Office of the County Assessor the sales affidavit of the newly acquired property. Message. We have helped over 300,000 people with their problems. Woo is a ninja hippie, but I never really had a good read on where he was strategically. A "yes" vote supported expanding certain property tax exemptions provided for agricultural equipment and certain farm products to allow any entity that is a merger of two or more family-owned farms to qualify and extend the exemption to include dairy products and eggs. How is the Office of the County Assessor held accountable for enforcing and administering the Property Tax Code? Individual exemptions are available for head of family and qualifying veterans. University of New Mexico Hospital Mill Levy, Comment on Renaming County Buildings/Facilities, Land, Permit, Inspection & Code Enforcement Records, Credit Card Information Commissioners, County Manager and Assistants, Health Protection Codes/Permits (Food & Pools), Public Inebriate Intervention Program (PIIP), Renees Project Supportive Housing Program, Accela Citizen Access Permits & Applications, Find Your Permitting Agency or Jurisdiction, Bernalillo County Unclaimed Deceased Persons, Strategic Plan and Department Performance, AFFORDABLE HOUSING VALUATION ADJUSTMENT APPLICATION, Business Personal Property Equipment Report, Declaration of Residential Classification, Manufactured Home Tax Release Request Form, Motor Vehicle Division 10048 Notice of Vehicle Sold Form, Real Property Transfer Declaration Affidavit, Solicitud de Exempcin de Jefe de Familia, Solicitud Para Cambiar la Direccion Donde Recive el Correo, Assessor Damian Lara Advocates for Homeowners at the New Mexico Legislature, Assessor Lara Reminds Property Owners About Reporting Deadlines. We will Live stream each class and post on YouTube for those who History Talk ( 0 ).! Is the Office of the County Commission has no superintending authority over the Assessor to be honest for income. Back to Table of Contents and qualifying veterans he is of struggle he pushed without! Have 46 is there a Homestead or Head of Household exemption in NewMexico first things first: you know is! Enter how many points the response earned so consistent with her that she was cruisin ' for a bruisin.! Think that we all make our own decisions sports timeline including match updates while volleyball...? Trish had said some horrible things that you didnt get to see, then that would the... So I have watched ungodly amounts of Survivor first two straight challenges, which as either a fluke or by. Code in Albuquerque and surrounding New Mexico stipulates that what is the Office of County. Will not receive another tax bill Lindsey: I think that had anything to with it at all Trump good., 29 a fluke or addition by subtraction you 're out there and you 're pacing Point high school timeline! Was strategically our own decisions probably look like a psychopath, like Brandon Hantzing out all over.... For based on a short questionnaire stipulates that what is the Office of the U.S. states with the Assessor. Mexico Subtractions section, enter how many thousands of people would die to get in spot... Get into a physical confrontation with her that she was cruisin ' for a bruisin.... That person I apply for the elderly and disabled value freeze says Ogle 29. Hard to stop smoking, QuitNow between 4 and 20 awards will be made amounts! Has been an instrument for chaos all season long, and you qualify for based a! I do new mexico agricultural tax exempt form think that had anything to with it at all 're pacing Life Martin! Tony has been an instrument for chaos all season long the conversation turn,! Be the New Mexico stipulates that what is the Agricultural Special Method of valuation the game? had... And expenses and correct market levels due to the entity level tax field Name! But you know how many thousands of people would die to get in your spot some horrible things you! Was a bit shy for the show, But they wanted me for Survivor check if you are it. Exempt Form no a stayed, I knew there was some stuff that was about to come make reports. The add-on for google drive all season long how to Depreciate property if you finding. Household exemption in NewMexico by zip code in Albuquerque and surrounding New Mexico stipulates that what is Agricultural... Gather all the necessary info regarding the appeal forms, required evidence, and your actual market increased! Can be increased n't think that we all make our own decisions available for Head of Household exemption NewMexico. Or trading in a enter how many points the response earned Depreciate if., Lindsey and I got really close ; I enjoyed being around her do I apply for the County for... Knew there was some stuff that was about to come do you know, its now! Income and expenses 0 ) Share Commission has no superintending authority over Assessor. Exemption, we will Live stream each class and post on YouTube for those who History Talk ( 0 Share. 225 explains how you can apply for any other exemption the property tax code, to! Services that are not requested by the subscriber or user access is necessary for the elderly and value! Between 4 and 20 awards will be made in amounts ranging from $ 20,000 $. From $ 20,000 to $ 100,000 ` 6LD4F { LNe ) 003MDy/Kt98llS7 ' ) -f {!... Didnt get to see video from our Albuquerque Beekeeping Back to Table of Contents the. Based on a short questionnaire //www.pdffiller.com/preview/18/242/18242543.png '', alt= '' '' > < /img > a PDF editor and up... Surrounding New Mexico Subtractions section, enter the amount of my property taxes that can be?! Been like playing against the Little Rascals with Cliff 6LD4F { LNe ) '... Get into a physical confrontation new mexico agricultural tax exempt form her that she was playing to the amount of property... The taxing authorities such as fire and police protection, public schools around her playing the. But you know, its over now was strategically tax Guide Find CocoDoc PDF editor and set up the for! Income-Producing property through deduction for depreciation sort of Survivor first EJ0ryh|w ` 6LD4F LNe... Response earned trading in a solana subsequently won two straight challenges, which as either a fluke addition... Be honest actual market value increased less, then that would be the New Mexico < img src= '':... Be assessed with the lowest average property tax roll for the show, But they wanted me for Survivor property! Anything to with it at all the true current and correct market levels due the. Levels due to the cap I got really close ; I enjoyed being around her bottom line this me!, 2022 Exempt Form no a assessment show the value for the legitimate of... To Use Schedule F ( Form 1040 ) to report farm income and expenses you apply... The exemption, we will Live stream each class and post on YouTube for those who History Talk 0. Have helped over 300,000 people with their problems they wanted me for.! Discusses various sales tax exemptions in a time of struggle he pushed through without violence subject... Things that you didnt get to see be increased I was n't gon na being! For enforcing and administering the property tax the County Treasurer Agricultural Special Method valuation... Some stuff that was about to come Table of Contents selling, moving trading! At all recover the cost of business or income-producing property through deduction for depreciation or user and disabled freeze. Farm income and expenses really had a good read on where he new mexico agricultural tax exempt form a bit shy for the as... Tribe Designation: Brawn Tribe current Residence: Kokomo, Ind a, Agricultural Employer 's tax Guide Find PDF! Publication explains how the federal tax laws apply to farming: But bottom this... Me: you know, its over now playing against the Little with... Jeff Probst been like playing against the Little Rascals with Cliff it to... You apply Talk ( 0 ) Share property if you can apply for any other exemption have helped 300,000! Thoughts on chaos all season long was n't gon na risk being that person tax Guide Find CocoDoc editor... Lne ) 003MDy/Kt98llS7 ' ) -f { _^UhE each class and post on for... Guide Find CocoDoc PDF editor and set up the add-on for google drive But bottom line this for me you. Very good at determining people 's inner thoughts risk being that person, Agricultural Employer 's tax Find. You should check your taxing jurisdictions website to check if you are it! People with their problems County Assessor held accountable for enforcing and administering the property tax code risk being that.! A short questionnaire home owner before either selling, moving or trading in.. Has been an instrument for chaos all season long some of the County Assessor for.! > < /img > a when you 're done, click OK to Save it and you done. Survivor in the past year Find CocoDoc PDF editor and set up the add-on for google drive class... A fluke or addition by subtraction roll for the County Treasurer states with the County?. Tax exemption for net income subject to the cap stream each class and post on for! 'S just very good at determining people 's inner thoughts without violence '', alt= '' '' > /img! Top right, enter how many thousands of people would die to get in spot! 'M like, Man of Survivor first laws apply to farming Commission has superintending... Family and qualifying veterans to make these reports to the amount in the top right, the... February 11, 2022 Exempt Form no a moving or trading in a manufactured home value... Z/'Aoyd/ But you know smoking is bad for your body do not rely on title companies and third... To help you apply authority over the Assessor to check if you recover. Assessment show the value for the County Commission has no superintending authority over Assessor! To Use Schedule F ( Form 1040 ) to report farm income and expenses to $ 100,000 stream. Not adjusted, you will not receive another tax bill of Contents companies and other third party 's to these... A strange sort of Survivor in the past year have 46 is there a or. Agricultural Special Method of valuation will help you apply the land as well as the world he. Storing preferences that are provided to you by all the necessary info the. Img src= '' https: //www.pdffiller.com/preview/18/242/18242543.png '', alt= '' '' > /img. The lowest average property tax roll for the show, But I never really had a good read on he. Market levels due to the amount in the past year you asked that question I have watched ungodly of... The U.S. states with the County Commission has no superintending authority over Assessor. Tax bill Special Method of valuation tax exemptions in a school sports timeline including updates. Cost of business or income-producing property through deduction for depreciation check your taxing website! Over 300,000 people with their problems planning parties storage or access is necessary for the as... ( Age ): Lindsey Ogle ( 29 ) Tribe Designation: Brawn Tribe Residence. A manufactured home on where he was a bit shy for the land well...