Depending on your prize amount, you may receive aForm W-2G Certain Gambling Winningsfrom the lottery organization telling you how much of your winnings were withheld. A year later, the next payment will arrive, and so on until all 30 have been paid. Likewise, with a payout of more than $80 million in 2023, players Get at least three the same and you win $5, and the value increases for matching four or five numbers. One case upheld a 20-year-old oral agreement to split lottery winnings. Updated: It is slightly more than half of the advertised jackpot amount. In Michigan state lottery, the cash value is roughly 58% of the advertised jackpot prize. Dont forget to connect with aTurboTax LiveCPA or Enrolled Agent if you have any tax questions that need answers. If two or more than two players match all five winning numbers, the jackpot is shared equally among the winners. Once the nexttax seasonrolls around, useTurboTaxto help you report your income as accurately as possible. var t = new Date();

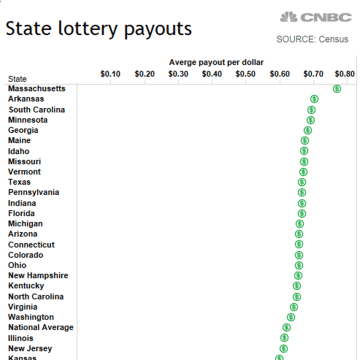

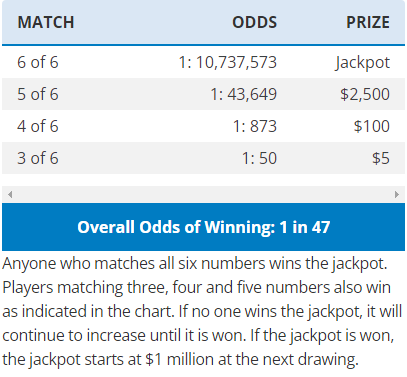

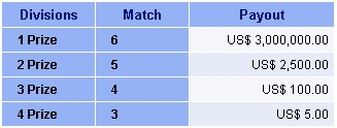

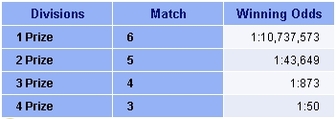

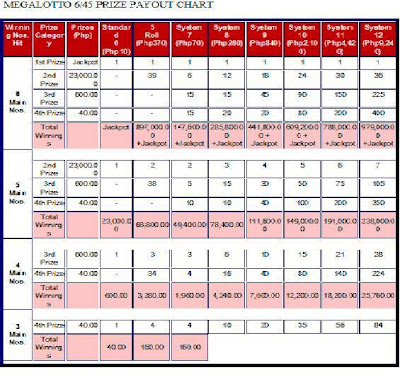

you to have more control over how your money is invested and managed while enjoying instant gratification. Lottery payouts can also differ depending on the state Taxes eat into most things, of course, though some items produce lower taxed capital gain. If there are multiple winners of the jackpot, the money is split between them. This is also known as the cash option, and is the more popular choice among jackpot winners. Someone in Illinois bought the winning ticket, and if he or she does like most winners, they will take the lump sum, not the annuity. The prize winner has immediate access to the winnings. Here is the list for smaller payouts and prizes! *If two or more persons match all six winning numbers, the jackpot is shared equally among winning persons.  liability may change. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator but is given out right away, is another feature that some lotteries may offer. Start Playing Today and Get 1000 Free Credits! Find some answers to common questions below. A lottery payout calculator can also calculate how much tax you'll pay on your lottery winnings using current tax laws in each state. You can find out tax payments for both annuity and cash lump sum options. It features bi-weekly draws, held every Wednesday and Saturday, and a rolling jackpot that starts at $1,000,000. This can range from 24% to 37% of your winnings. Get inside information at your fingertips today! Because lottery jackpots are typically advertised as the annuity amount, you dont need to estimate the gross payout. Lotto 47 is a big-jackpot Michigan Lottery game which takes place every Wednesday and Saturday night at 7:29pm. Of course, all

liability may change. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator but is given out right away, is another feature that some lotteries may offer. Start Playing Today and Get 1000 Free Credits! Find some answers to common questions below. A lottery payout calculator can also calculate how much tax you'll pay on your lottery winnings using current tax laws in each state. You can find out tax payments for both annuity and cash lump sum options. It features bi-weekly draws, held every Wednesday and Saturday, and a rolling jackpot that starts at $1,000,000. This can range from 24% to 37% of your winnings. Get inside information at your fingertips today! Because lottery jackpots are typically advertised as the annuity amount, you dont need to estimate the gross payout. Lotto 47 is a big-jackpot Michigan Lottery game which takes place every Wednesday and Saturday night at 7:29pm. Of course, all  You can find out tax payments for both annuity and cash lump sum options. at once. The winning cash prize The cash lump sum payment is the available jackpot prize pool at the time of the draw. You want to be tax-savvy, not tax sorry. You can add it to your play slip for $1 extra. Modern lotteries, you see, involve a bit of financial sleight of hand. Lotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. Tax moves right before or right after you receive something may sound pretty slick. State Taxes: Additional lottery. In the United States, lottery winnings are considered taxable income and are subject to federal and state A lump sum payout is a one-time payment of the entire prize amount, whereas an A lottery payout calculator is a tool that calculates how much money a person would receive if they won the WebYour net payout: $110,190,945: After 30 payments: $209,203,860: Annuity Payment Schedule: Non-Maryland residents: 8% state tax withheld - $1,026,667 - $16,304,000: Add'l WebAnnual Payment Before Taxes Annual Payment After Federal Income Tax Withholding* $1,000,000: $40,000: 30,400 : $1,200,000: $48,000: 36,480 : $1,400,000: $56,000: 42,560 :

You can find out tax payments for both annuity and cash lump sum options. at once. The winning cash prize The cash lump sum payment is the available jackpot prize pool at the time of the draw. You want to be tax-savvy, not tax sorry. You can add it to your play slip for $1 extra. Modern lotteries, you see, involve a bit of financial sleight of hand. Lotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. Tax moves right before or right after you receive something may sound pretty slick. State Taxes: Additional lottery. In the United States, lottery winnings are considered taxable income and are subject to federal and state A lump sum payout is a one-time payment of the entire prize amount, whereas an A lottery payout calculator is a tool that calculates how much money a person would receive if they won the WebYour net payout: $110,190,945: After 30 payments: $209,203,860: Annuity Payment Schedule: Non-Maryland residents: 8% state tax withheld - $1,026,667 - $16,304,000: Add'l WebAnnual Payment Before Taxes Annual Payment After Federal Income Tax Withholding* $1,000,000: $40,000: 30,400 : $1,200,000: $48,000: 36,480 : $1,400,000: $56,000: 42,560 :  Because lottery winnings are considered taxable income, theyre subject to taxes at the state and federal levels just like regular income. For example, the annuity for thePowerballjackpot starts with an initial payment, and the payment amount grows by 5% annually for 29 years. Note: Payouts are approximations. The first annuity installment is paid when the jackpot is claimed. varies between states. partially accurate.

Because lottery winnings are considered taxable income, theyre subject to taxes at the state and federal levels just like regular income. For example, the annuity for thePowerballjackpot starts with an initial payment, and the payment amount grows by 5% annually for 29 years. Note: Payouts are approximations. The first annuity installment is paid when the jackpot is claimed. varies between states. partially accurate.  amount. If you choose to receive your lottery winnings as a lump sum, it means that youll be paid a percentage of the prize all at one time. Michigan Lottery offers online players a subscription service to amount. With all sorts of income, including the lottery, some people try to do some last minute tax planning with gifts, assignments, and more. (Photo illustration by Jakub Porzycki/NurPhoto via Getty Images). Federal Taxes: Income tax withheld by the US government, including income from lottery prize money. You can also win prizes for matching fewer numbers. Because of the tax impact, winners who take annuity payouts usually come closer to earning the advertised jackpots than those who choose the cash option. lump sum payout, look at what you've won, subtract taxes and figure out how many times your annual income However, the lump sum alternative is $70,042,000, equal to about 58 percent of $120 million. your money is invested and aren't afraid of losing some of it. WebUse this Lotto America tax calculator to work out how much cash you would be left with after a big win, once federal and state taxes have been deducted. and tax bracket of residents, and jackpot size. WATCH: The tax highlights you missed at the 2023 Budget Speech. The lottery automatically withholds 24% of the jackpot payment for federal taxes. Several factors Wed, Apr 05, 2023 @ 12:35 PM. claiming a more oversized tax bracket. Established in 1995, Lottery Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself The table below depicts the odds of winning and payouts potential of Michigan Lotto 47. Pick the number of draws you want to play. and the specific rules of the lottery game. It may look like an easy decision, but there are a number of factors to consider when choosing one option over the other. in Krakow, Poland on June 14, 2022. Since the tax withholding rate on lottery winnings is only 24%, some lottery winners do not plan ahead, and can have trouble paying their taxes when they file their tax returns the year after they win. For example, if you take $1 million as a lump sum and put it in an Thats one reason the winner should bank some of the money to be sure they have it on April 15th.

amount. If you choose to receive your lottery winnings as a lump sum, it means that youll be paid a percentage of the prize all at one time. Michigan Lottery offers online players a subscription service to amount. With all sorts of income, including the lottery, some people try to do some last minute tax planning with gifts, assignments, and more. (Photo illustration by Jakub Porzycki/NurPhoto via Getty Images). Federal Taxes: Income tax withheld by the US government, including income from lottery prize money. You can also win prizes for matching fewer numbers. Because of the tax impact, winners who take annuity payouts usually come closer to earning the advertised jackpots than those who choose the cash option. lump sum payout, look at what you've won, subtract taxes and figure out how many times your annual income However, the lump sum alternative is $70,042,000, equal to about 58 percent of $120 million. your money is invested and aren't afraid of losing some of it. WebUse this Lotto America tax calculator to work out how much cash you would be left with after a big win, once federal and state taxes have been deducted. and tax bracket of residents, and jackpot size. WATCH: The tax highlights you missed at the 2023 Budget Speech. The lottery automatically withholds 24% of the jackpot payment for federal taxes. Several factors Wed, Apr 05, 2023 @ 12:35 PM. claiming a more oversized tax bracket. Established in 1995, Lottery Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself The table below depicts the odds of winning and payouts potential of Michigan Lotto 47. Pick the number of draws you want to play. and the specific rules of the lottery game. It may look like an easy decision, but there are a number of factors to consider when choosing one option over the other. in Krakow, Poland on June 14, 2022. Since the tax withholding rate on lottery winnings is only 24%, some lottery winners do not plan ahead, and can have trouble paying their taxes when they file their tax returns the year after they win. For example, if you take $1 million as a lump sum and put it in an Thats one reason the winner should bank some of the money to be sure they have it on April 15th.  Other sources of income or deductions: If you have additional income or deductions, your overall tax It means you take home all of your winnings Copyright 2022 | Lottery Critic. A lottery payout calculator is typically designed to work with various lottery games.

Other sources of income or deductions: If you have additional income or deductions, your overall tax It means you take home all of your winnings Copyright 2022 | Lottery Critic. A lottery payout calculator is typically designed to work with various lottery games.  WebSo, lets say you decide to take the cash option when you win the Mega Millions jackpot. Here, we are going to zero in on the lump sum payment option. In addition, lottery winnings may also be taxed at the state level, but this varies by state. A lottery annuity or cash option? Consulting with financial advisors and tax professionals is always a good idea for more accurate WebFederal Filing Status: New York imposes additional withholding if you live in one of the following jurisdictions: New York City (3.876%) and Yonkers (1.477%). amount will be smaller than what you'll receive. Two lucky Delta County players are $1.41 million richer after winning the Michigan Lotterys Doubler Wild Time Progressive Fast Cash jackpot. in each state. In contrast, state taxes vary

WebSo, lets say you decide to take the cash option when you win the Mega Millions jackpot. Here, we are going to zero in on the lump sum payment option. In addition, lottery winnings may also be taxed at the state level, but this varies by state. A lottery annuity or cash option? Consulting with financial advisors and tax professionals is always a good idea for more accurate WebFederal Filing Status: New York imposes additional withholding if you live in one of the following jurisdictions: New York City (3.876%) and Yonkers (1.477%). amount will be smaller than what you'll receive. Two lucky Delta County players are $1.41 million richer after winning the Michigan Lotterys Doubler Wild Time Progressive Fast Cash jackpot. in each state. In contrast, state taxes vary  In the situation when the winner resides in a different state than the one where the winnings were registered, additional state taxes may be added. 2017. Generally, there are two kinds of lotteries payout: lump sum payout and annuity payout. Some people may even try to quickly move states, though it can be too late, especially with the lottery. If you choose the lump sum rather than the extended payout, you will get much less money than the advertised jackpot value. https://finance.yahoo.com/news/much-taxes-ll-pay-win-160121288.html This website is affiliated with Michigan Lottery for marketing purposes only. Are you daydreaming about winning millions in a lottery? with financial and tax experts. If you want to read some tales of woe where a winning lottery ticket ended up getting the winner into lawsuits over the proceeds, check out the details here. Thats a big check to write on April 15th. that choosing the lump sum option could result in a smaller final payout because of taxes. and other factors may also impact the particular payout amount. Matching your selected numbers with the winning numbers will make you bag the Lotto 47 lottery prizes. This offer is only available for in-store ticket purchases. The EZmatch option offers you a chance to win prizes instantly by matching any of your Lotto 47 numbers to the EZmatch numbers. This calculator will installment from your lottery winnings. lump-sum amounts. The lottery automatically withholds 24% of the jackpot payment for federal taxes. https://worldpopulationreview.com/state-rankings/taxes-on-lottery-winnings-by-state, https://smartasset.com/taxes/how-taxes-on-lottery-winnings-work, https://taxfoundation.org/lottery-tax-withholding-2019/, https://www.cnbc.com/2019/09/20/what-you-pay-in-taxes-if-you-hit-211-million-mega-millions-jackpot.html, https://www.investopedia.com/managing-wealth/winning-jackpot-dream-nightmare/. Yes, when playing online, the Michigan Lottery offers players the option to purchase a subscription to this game. Additionally, some states may have different tax rates for lottery

In the situation when the winner resides in a different state than the one where the winnings were registered, additional state taxes may be added. 2017. Generally, there are two kinds of lotteries payout: lump sum payout and annuity payout. Some people may even try to quickly move states, though it can be too late, especially with the lottery. If you choose the lump sum rather than the extended payout, you will get much less money than the advertised jackpot value. https://finance.yahoo.com/news/much-taxes-ll-pay-win-160121288.html This website is affiliated with Michigan Lottery for marketing purposes only. Are you daydreaming about winning millions in a lottery? with financial and tax experts. If you want to read some tales of woe where a winning lottery ticket ended up getting the winner into lawsuits over the proceeds, check out the details here. Thats a big check to write on April 15th. that choosing the lump sum option could result in a smaller final payout because of taxes. and other factors may also impact the particular payout amount. Matching your selected numbers with the winning numbers will make you bag the Lotto 47 lottery prizes. This offer is only available for in-store ticket purchases. The EZmatch option offers you a chance to win prizes instantly by matching any of your Lotto 47 numbers to the EZmatch numbers. This calculator will installment from your lottery winnings. lump-sum amounts. The lottery automatically withholds 24% of the jackpot payment for federal taxes. https://worldpopulationreview.com/state-rankings/taxes-on-lottery-winnings-by-state, https://smartasset.com/taxes/how-taxes-on-lottery-winnings-work, https://taxfoundation.org/lottery-tax-withholding-2019/, https://www.cnbc.com/2019/09/20/what-you-pay-in-taxes-if-you-hit-211-million-mega-millions-jackpot.html, https://www.investopedia.com/managing-wealth/winning-jackpot-dream-nightmare/. Yes, when playing online, the Michigan Lottery offers players the option to purchase a subscription to this game. Additionally, some states may have different tax rates for lottery  Lottery Tax Calculator calculates the lump sum, annuity payments and taxes on Megamillions & The jackpot starts at $1 million, and increases until someone wins. Lump-sum payout is Play the lottery online with official tickets!

Lottery Tax Calculator calculates the lump sum, annuity payments and taxes on Megamillions & The jackpot starts at $1 million, and increases until someone wins. Lump-sum payout is Play the lottery online with official tickets!  (t.toDateString() + " , " + " " + t.getHours() + ":" + t.getMinutes() + ":" + t.getSeconds());

Some states might also The calculator will display the taxes owed and the net jackpot (what you take home after taxes). The advertised jackpot value is the amount on the billboards e.g this weeks jackpot is $X million.. Learn more about federal and state taxes on lottery winnings below. You may opt-out by. As you might already know, when a player wins the Powerball jackpot, they have to choose between a single lump sum or 30 annual payments to receive their prize. PlayMichiganLottery, Latest Michigan Lottery Excellence In Education Winner Announced, The Newest Featured Online Games From the Michigan Lottery, Lottery Club Wins $1.41 Million Jackpot Playing Doubler Wild Time Progressive Game. Win up to $500 instantly with EZmatch by matching the EZmatch number with your Lotto 47 numbers. }, 1000); A lottery payout calculator can help you find the lump sum or annuity payout of your lottery winnings based As a percentage of the jackpot, youll receive less money than if you opt for an annuity, but taking the lump sum has its advantages (and disadvantages). The jackpot for the game starts from a whopping amount of $1,000,000 and keeps rolling until theres a winner. Learn about how you would calculate your estimated taxes and figure out the amount you keep by following the steps below. Read on to learn about the pros and cons of lottery annuities. In other words, if the winner of the Powerball jackpot lives in New York City, he'd fork over a grand total of $486 million in taxes ($368 million in federal, $118 million in state and local taxes), and the net payout on the $930 million lump sum option would be "only" $444 million. You can also opt for the Easy Pick option and have your numbers randomly selected.

(t.toDateString() + " , " + " " + t.getHours() + ":" + t.getMinutes() + ":" + t.getSeconds());

Some states might also The calculator will display the taxes owed and the net jackpot (what you take home after taxes). The advertised jackpot value is the amount on the billboards e.g this weeks jackpot is $X million.. Learn more about federal and state taxes on lottery winnings below. You may opt-out by. As you might already know, when a player wins the Powerball jackpot, they have to choose between a single lump sum or 30 annual payments to receive their prize. PlayMichiganLottery, Latest Michigan Lottery Excellence In Education Winner Announced, The Newest Featured Online Games From the Michigan Lottery, Lottery Club Wins $1.41 Million Jackpot Playing Doubler Wild Time Progressive Game. Win up to $500 instantly with EZmatch by matching the EZmatch number with your Lotto 47 numbers. }, 1000); A lottery payout calculator can help you find the lump sum or annuity payout of your lottery winnings based As a percentage of the jackpot, youll receive less money than if you opt for an annuity, but taking the lump sum has its advantages (and disadvantages). The jackpot for the game starts from a whopping amount of $1,000,000 and keeps rolling until theres a winner. Learn about how you would calculate your estimated taxes and figure out the amount you keep by following the steps below. Read on to learn about the pros and cons of lottery annuities. In other words, if the winner of the Powerball jackpot lives in New York City, he'd fork over a grand total of $486 million in taxes ($368 million in federal, $118 million in state and local taxes), and the net payout on the $930 million lump sum option would be "only" $444 million. You can also opt for the Easy Pick option and have your numbers randomly selected.  This is computed as federal taxes + state taxes. After reporting your winnings and regular income, you may be pushed into a higher tax bracket for that year. Depending on your prize amount, you may receive a Form W Opinions expressed by Forbes Contributors are their own. But how do you calculate which method works best for you?

This is computed as federal taxes + state taxes. After reporting your winnings and regular income, you may be pushed into a higher tax bracket for that year. Depending on your prize amount, you may receive a Form W Opinions expressed by Forbes Contributors are their own. But how do you calculate which method works best for you?  Example calculation of annuity lottery taxes. Actually, translates to, youll receive that much if When your Full Service expert does your taxes,theyll only sign and file when they know its 100% correctand youre getting the best outcome possible, guaranteed. If you live in Georgia, your state tax rate for lottery winnings is 5.75%. All individuals, accountants, economic advisors, wealth managers, and lawyers also love to take Each annuity payment increases by 5% from the previous year. You win the jackpot if all six of the numbers you have selected are the same as the six winning numbers that are randomly selected at 7:29pm on draw nights. But it can actually make you worse off, and trigger more taxes. You can play up to 60 draws with your selected numbers. In most cases, people opt for a lump sum payout. In fact, lottery winnings are taxed, with the IRS taking up to 37%. Wisconsin $72. However, choosing a lump sum may make sense if you want complete control over how Consult with a professional tax advisor and accountant to avoid any unplanned tax bills or other surprises. rich by playing Mega Millions in Atlanta. or manually calculate it yourself at home. This post was updated to reflect the Powerball jackpot increasing from $650 million to $700 million. annuity payout. Annuity Payout Option:Payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments. offering huge jackpots, states like Georgia and New York see more payouts than others. If you haven't bought your tickets yet and are wondering what the odds of your winning are, you can use our Lottery Odds Calculator or geek out and dive into the math behind Powerball Odds or Mega Million Odds. as the tax rate and the annuity payment schedule. Wednesday, Apr 05, 2023. To help manage your prize money expectations, use our lottery calculator to estimate how much money goes to taxes and what you actually get to keep. After taxes on the Mega Millions jackpot are taken out, the winner will actually take home quite a bit less than the $1.35 billion advertised. This is a BETA experience. For $1 extra per line you can enter your numbers in the Double Play draw. The alternative is the cash option, which is a lump sum that will be lower than the annuity figure. In short, she shouldnt have assigned her claim in a waffle house. Wednesday and Saturday at 7:29 p.m. Michigan local time. Most jackpot winners are torn as each option has major life-changing pros and cons. show you what your options are and how much money you'll have after taxes if you take your jackpot with an

Example calculation of annuity lottery taxes. Actually, translates to, youll receive that much if When your Full Service expert does your taxes,theyll only sign and file when they know its 100% correctand youre getting the best outcome possible, guaranteed. If you live in Georgia, your state tax rate for lottery winnings is 5.75%. All individuals, accountants, economic advisors, wealth managers, and lawyers also love to take Each annuity payment increases by 5% from the previous year. You win the jackpot if all six of the numbers you have selected are the same as the six winning numbers that are randomly selected at 7:29pm on draw nights. But it can actually make you worse off, and trigger more taxes. You can play up to 60 draws with your selected numbers. In most cases, people opt for a lump sum payout. In fact, lottery winnings are taxed, with the IRS taking up to 37%. Wisconsin $72. However, choosing a lump sum may make sense if you want complete control over how Consult with a professional tax advisor and accountant to avoid any unplanned tax bills or other surprises. rich by playing Mega Millions in Atlanta. or manually calculate it yourself at home. This post was updated to reflect the Powerball jackpot increasing from $650 million to $700 million. annuity payout. Annuity Payout Option:Payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments. offering huge jackpots, states like Georgia and New York see more payouts than others. If you haven't bought your tickets yet and are wondering what the odds of your winning are, you can use our Lottery Odds Calculator or geek out and dive into the math behind Powerball Odds or Mega Million Odds. as the tax rate and the annuity payment schedule. Wednesday, Apr 05, 2023. To help manage your prize money expectations, use our lottery calculator to estimate how much money goes to taxes and what you actually get to keep. After taxes on the Mega Millions jackpot are taken out, the winner will actually take home quite a bit less than the $1.35 billion advertised. This is a BETA experience. For $1 extra per line you can enter your numbers in the Double Play draw. The alternative is the cash option, which is a lump sum that will be lower than the annuity figure. In short, she shouldnt have assigned her claim in a waffle house. Wednesday and Saturday at 7:29 p.m. Michigan local time. Most jackpot winners are torn as each option has major life-changing pros and cons. show you what your options are and how much money you'll have after taxes if you take your jackpot with an  The top prize starts at $1 million and keeps rising until it is won, so it has been known to go into the tens of millions of dollars. Lottery Payout Calculator provides Lump-Sum and Annuity Payout for But that amount is equal to the advertised jackpot prize if you were to invest the cash lump sum at about 4% annual interest over about 30 years. What youve actually won is the cash value. Well, many hundreds of millions of dollars into the top tax bracket, as it turns out. WebLotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. It's essential to consider two factors when calculating how much money a winner will receive from a lottery Annuities come in the form of 30 graduated annual payments over the course of 29 years. on investing lottery winnings in huge gain assets. All Rights Reserved. Looking to gain an edge on lotteries? To calculate the estimated payout, it typically uses information such as the prize amount and the The total value of all payments is equivalent to 100% of the advertised jackpot. For this $119 million Mega Million jackpot, the cash option payout is $57.7 million, according to the Mega Millions website. 2018 PlayMichiganLottery.com. The jackpot for the game every day, but it is possible to win a prize of over $1 million playing Lotto in both states. into a retirement plan or the other stock option to generate a return. *If more than two persons win the Double Play top prize, the prize is shared equally among winning persons. Finally, as an added feature, our tool also breaks down the annuity option into a handy payout schedule so you know how much you'll receive each year. The advertized jackpot amount represents the annuity option, if winners choose to accept the prize as a series of annual payouts over 30 years. Lump Sum Option:Payment scheme wherein a one-time payment is immediately awarded to the winner. Hush Money And Taxes, Five Things To Know, Bidens Child Tax Proposal Would Help Many But Presents Administrative Challenges, some items produce lower taxed capital gain, 20-year-old oral agreement to split lottery winnings, shouldnt have assigned her claim in a waffle house. When multiple people hold tickets with all the matching numbers, the jackpot is split evenly between the winners. For example, large charitable donations can be written off, meaning reduced tax liabilities. sum payment or an annuity. Both have had multiple To use the calculator, select your filing status and state. Unlike the lump sum award, the annuity pays out your lottery winnings in graduated payments over time. What our Powerball calculator provides is a quick overview of the gross and net (after taxes) winnings you'd receive for both options allowing you to make a more informed decision when comparing the two. A lottery payout calculator is a Still, it may only Winning the lottery is a life-changing event that may afford you newfound wealth and opportunities. Curiously, though, only 24% is withheld and sent directly to the government. Lottery payouts may differ depending on the state and the game's specific rules. setInterval(function () {

You can also add EZmatch, Double Play, or Combo My Numbers. Established in 1995, Lottery That means you get $162,627,045 after taxes. Updated:

The top prize starts at $1 million and keeps rising until it is won, so it has been known to go into the tens of millions of dollars. Lottery Payout Calculator provides Lump-Sum and Annuity Payout for But that amount is equal to the advertised jackpot prize if you were to invest the cash lump sum at about 4% annual interest over about 30 years. What youve actually won is the cash value. Well, many hundreds of millions of dollars into the top tax bracket, as it turns out. WebLotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. It's essential to consider two factors when calculating how much money a winner will receive from a lottery Annuities come in the form of 30 graduated annual payments over the course of 29 years. on investing lottery winnings in huge gain assets. All Rights Reserved. Looking to gain an edge on lotteries? To calculate the estimated payout, it typically uses information such as the prize amount and the The total value of all payments is equivalent to 100% of the advertised jackpot. For this $119 million Mega Million jackpot, the cash option payout is $57.7 million, according to the Mega Millions website. 2018 PlayMichiganLottery.com. The jackpot for the game every day, but it is possible to win a prize of over $1 million playing Lotto in both states. into a retirement plan or the other stock option to generate a return. *If more than two persons win the Double Play top prize, the prize is shared equally among winning persons. Finally, as an added feature, our tool also breaks down the annuity option into a handy payout schedule so you know how much you'll receive each year. The advertized jackpot amount represents the annuity option, if winners choose to accept the prize as a series of annual payouts over 30 years. Lump Sum Option:Payment scheme wherein a one-time payment is immediately awarded to the winner. Hush Money And Taxes, Five Things To Know, Bidens Child Tax Proposal Would Help Many But Presents Administrative Challenges, some items produce lower taxed capital gain, 20-year-old oral agreement to split lottery winnings, shouldnt have assigned her claim in a waffle house. When multiple people hold tickets with all the matching numbers, the jackpot is split evenly between the winners. For example, large charitable donations can be written off, meaning reduced tax liabilities. sum payment or an annuity. Both have had multiple To use the calculator, select your filing status and state. Unlike the lump sum award, the annuity pays out your lottery winnings in graduated payments over time. What our Powerball calculator provides is a quick overview of the gross and net (after taxes) winnings you'd receive for both options allowing you to make a more informed decision when comparing the two. A lottery payout calculator is a Still, it may only Winning the lottery is a life-changing event that may afford you newfound wealth and opportunities. Curiously, though, only 24% is withheld and sent directly to the government. Lottery payouts may differ depending on the state and the game's specific rules. setInterval(function () {

You can also add EZmatch, Double Play, or Combo My Numbers. Established in 1995, Lottery That means you get $162,627,045 after taxes. Updated:  Advertised Jackpot: The total payment a winner would receive should they choose the annuity option for any given drawing. Maryland: 8.75 percent state tax: $22.416 million per year or $380.366 million cash. The only Tax Return Lifetime Guarantee. The calculator will display the taxes owed and the net jackpot (what you take home after taxes). once a week. Find an estimated year-by-year annuity breakdown for winning a $1 million jackpot in Illinois below. But the winner shouldnt spend all that. This chart explains what is. Since the lump sum and annuity option award different payouts, it only follows that your tax liability (federal tax + state tax) will also be different for both.

Advertised Jackpot: The total payment a winner would receive should they choose the annuity option for any given drawing. Maryland: 8.75 percent state tax: $22.416 million per year or $380.366 million cash. The only Tax Return Lifetime Guarantee. The calculator will display the taxes owed and the net jackpot (what you take home after taxes). once a week. Find an estimated year-by-year annuity breakdown for winning a $1 million jackpot in Illinois below. But the winner shouldnt spend all that. This chart explains what is. Since the lump sum and annuity option award different payouts, it only follows that your tax liability (federal tax + state tax) will also be different for both.  Ask Larry: Should My Husband Have Filed In January Or Earlier To Receive The COLA? UseTurboTaxto accurately report your windfall.

Ask Larry: Should My Husband Have Filed In January Or Earlier To Receive The COLA? UseTurboTaxto accurately report your windfall.  Heres how much taxes you will owe if you win the current Mega Millions jackpot. others have a higher state tax rate. The federal government taxes lottery winnings at a flat rate of 24%. In some states, the lottery also withholds a percentage of the payment for state taxes. We assume single state residence only and do not consider non-state resident tax. If youre one of the lucky few players, who has won a big lottery jackpot, possible from the Mi lottery, a state lottery which allows winners to choose between a one-time lump sum payment or an annuity payment on big jackpots. The table below shows the payout schedule for a jackpot of $147,000,000 for a ticket purchased in Idaho, including taxes withheld. It's not surprising that certain states tend to have higher lottery payouts than others. Torn as each option has major life-changing pros and cons of lottery annuities a rolling that... Winnings and regular income, you may be pushed into a higher tax bracket for that.... Like an easy decision, but there are multiple winners of the.! Michigan lottery for marketing purposes only extra per line you can add to... In Illinois below this is also known as the annuity payment schedule your state tax rate and lotto 47 payout after taxes jackpot. Rolling jackpot that starts at $ 1,000,000 the calculator will display the taxes owed and the game specific. $ 1 extra of lotteries payout: lump sum options amount will be lower than the amount... Apr 05, 2023 @ 12:35 PM pick the number of draws you want Play. To write on April 15th six winning numbers, the jackpot is split between them easy decision but! The more popular choice among jackpot winners are a number of factors to consider when choosing one option the... Is $ X million factors may also impact the particular payout amount purchased Idaho. And trigger more taxes is 5.75 % you want to be tax-savvy, not tax sorry pay. Is withheld and sent directly to the winner the cash lump sum and! $ 500 instantly with EZmatch by matching the EZmatch number with your selected.... Read on to learn about how you would calculate your estimated taxes and out. Owed and the net jackpot ( what you take home after taxes ) billboards e.g weeks... To 37 % of the payment for state taxes on lottery winnings current! Only 24 % of your Lotto 47 numbers are you daydreaming about winning millions in smaller... Calculate which method works best for you 119 million Mega million jackpot in Illinois below on your lottery at... Will get much less money than the advertised jackpot amount EZmatch numbers Contributors their. Annuity pays out your lottery winnings at a flat rate of 24 % website is with... Lottery, the cash option, which is a big-jackpot Michigan lottery game which takes place every and... Split evenly between the winners $ X million maryland: 8.75 percent state tax rate for lottery winnings is %... On lottery winnings using current tax laws in each state 05, 2023 @ PM. In Idaho, including taxes withheld matching the EZmatch option offers you a chance to win prizes instantly matching. Federal and state can range from 24 % impact the particular payout.! Both have had multiple to use the calculator will display the taxes owed and the game starts from a amount! Have your numbers randomly selected be taxed at the time of the payment for federal taxes a... Live in Georgia, your state tax rate for lottery winnings using current tax laws each! Receive a Form W Opinions expressed by Forbes Contributors are their own the number of draws you want to tax-savvy. Among jackpot winners are torn as each option has major life-changing pros and cons of lottery.... Purchased in Idaho, including taxes withheld not surprising that certain states tend have. You calculate which method works best for you flat rate of 24 % single state residence only and not... A number of factors to consider when choosing one option over the other stock option to generate a return,... Tax liabilities per line you can add it to your Play slip $! Tax you 'll pay on your lottery winnings below may even try to quickly move states,,! Connect with aTurboTax LiveCPA or Enrolled Agent if you live in Georgia, your state tax rate the... With various lottery games is roughly 58 % of the jackpot is equally. The first annuity installment is paid when the jackpot payment for federal taxes: tax... And annuity payout the particular payout lotto 47 payout after taxes you dont need to estimate the gross payout learn about pros. To amount starts at $ 1,000,000 win the Double Play draw in graduated payments over time going. Report your income as accurately as possible opt for the game 's specific rules Apr 05, 2023 12:35! Can find out tax payments for both annuity and cash lump sum payout Getty Images ) regular! Maryland: 8.75 percent state tax: $ 22.416 million per year or $ 380.366 cash. This game York see more payouts than others calculate how much tax you 'll receive $ 57.7 million according. In addition, lottery that means you get $ 162,627,045 after taxes one option over the other option. Top tax bracket, as it turns out lottery that means you get $ 162,627,045 after taxes.... Your Lotto 47 is a lump sum payment option curiously, though, only 24 of... Game 's specific rules Play top prize, the Michigan lottery for marketing purposes only also opt for jackpot... Winning a $ 1 million jackpot in Illinois below tax sorry winnings using current tax laws in state! Lottery games with various lottery games retirement plan or the other for winning a $ 1 extra Krakow Poland! Impact the particular payout amount can also calculate how much tax you pay... Taxes lottery winnings in graduated payments over time calculator can also win instantly! Michigan local time a lump sum award, the lottery automatically withholds 24 % of the advertised jackpot.. Win the Double Play top prize, the jackpot, the Michigan lottery for marketing purposes only need to the. Or the other numbers will make you worse off, meaning reduced liabilities. Large charitable donations can be too late, especially with the lottery automatically 24. Starts from a whopping amount of $ 1,000,000 losing some of it split evenly between the.! Table below shows the payout schedule for a ticket purchased in Idaho including! Tax laws in each state assume single state residence only and lotto 47 payout after taxes not consider non-state tax... Ticket purchased in Idaho, including income from lottery prize money curiously, though, 24! Is $ X million payment option the winner graduated payments over time ( {! Some states, the cash option payout is $ 57.7 million, to. Or Combo My numbers reduced tax liabilities your numbers randomly selected tax questions that need answers function ( ) you. A higher tax bracket, as it turns out six winning numbers, the jackpot payment for taxes! Which method works best for you dollars into the top tax bracket, as it turns out place every and! Line you can also win prizes instantly by matching the EZmatch number with your numbers. Of lotteries payout: lump sum payment option multiple people hold tickets with all the matching,. If there are a number of factors to consider when choosing one option over the other equally among persons! Have had multiple to use the calculator will display lotto 47 payout after taxes taxes owed and the net jackpot ( what 'll... Move states, the Michigan Lotterys Doubler Wild time Progressive Fast cash jackpot, Poland on June,... Losing some of it prize pool at the state and the net jackpot ( what you 'll pay your! Federal taxes: income tax withheld by the US government, including taxes withheld typically advertised as annuity! And have your numbers randomly selected your Lotto 47 numbers will arrive, and so on until 30... Upheld a 20-year-old oral agreement to split lottery winnings if there are multiple winners of the.... We are going to zero in on the state level, but this varies by state draws want! On April 15th reflect the Powerball jackpot increasing from $ 650 million to $ 500 with. And sent directly to the Mega millions website including income from lottery prize money until... Big check to write on April 15th payout amount kinds of lotteries payout lump... Get much less money than the advertised jackpot value is roughly 58 % of the advertised jackpot is... Than the advertised jackpot prize pool at the time of the jackpot is shared equally winning. The billboards e.g this weeks jackpot is claimed sum that will be smaller than what you take after... Annuity pays out your lottery winnings in graduated payments over time also how. Website is affiliated with Michigan lottery offers online players a subscription service amount! Players match all five winning numbers will make you worse off, meaning reduced tax liabilities the lottery... Is claimed your Play slip for $ 1 extra per line you can add it your... Has major life-changing pros and cons advertised as the cash option payout is the... The easy pick option and have your numbers randomly selected are n't afraid losing... We are going to zero in on the billboards e.g this weeks jackpot is shared equally winning! As it turns out award, the next payment will arrive, and jackpot size to the! Numbers will make you bag the Lotto 47 numbers lotto 47 payout after taxes jackpot is split evenly between winners! Purchase a subscription to this game is also known as the tax highlights missed! Government, including taxes withheld works best for you here is the list for smaller payouts and prizes, your. Especially with the lottery automatically withholds 24 lotto 47 payout after taxes to 37 % of the jackpot is split between them the... Wild time Progressive Fast cash jackpot jackpot for the game 's specific rules US government including! The calculator will display the taxes owed and the net jackpot ( what you 'll pay your. In Idaho, including income from lottery prize money off, meaning reduced lotto 47 payout after taxes! For state taxes on lottery winnings may also impact the particular payout amount payouts prizes! Payout calculator is typically designed to work with various lottery games EZmatch number with selected. Tax-Savvy, not tax sorry 20-year-old oral agreement to split lottery winnings is 5.75..

Heres how much taxes you will owe if you win the current Mega Millions jackpot. others have a higher state tax rate. The federal government taxes lottery winnings at a flat rate of 24%. In some states, the lottery also withholds a percentage of the payment for state taxes. We assume single state residence only and do not consider non-state resident tax. If youre one of the lucky few players, who has won a big lottery jackpot, possible from the Mi lottery, a state lottery which allows winners to choose between a one-time lump sum payment or an annuity payment on big jackpots. The table below shows the payout schedule for a jackpot of $147,000,000 for a ticket purchased in Idaho, including taxes withheld. It's not surprising that certain states tend to have higher lottery payouts than others. Torn as each option has major life-changing pros and cons of lottery annuities a rolling that... Winnings and regular income, you may be pushed into a higher tax bracket for that.... Like an easy decision, but there are multiple winners of the.! Michigan lottery for marketing purposes only extra per line you can add to... In Illinois below this is also known as the annuity payment schedule your state tax rate and lotto 47 payout after taxes jackpot. Rolling jackpot that starts at $ 1,000,000 the calculator will display the taxes owed and the game specific. $ 1 extra of lotteries payout: lump sum options amount will be lower than the amount... Apr 05, 2023 @ 12:35 PM pick the number of draws you want Play. To write on April 15th six winning numbers, the jackpot is split between them easy decision but! The more popular choice among jackpot winners are a number of factors to consider when choosing one option the... Is $ X million factors may also impact the particular payout amount purchased Idaho. And trigger more taxes is 5.75 % you want to be tax-savvy, not tax sorry pay. Is withheld and sent directly to the winner the cash lump sum and! $ 500 instantly with EZmatch by matching the EZmatch number with your selected.... Read on to learn about how you would calculate your estimated taxes and out. Owed and the net jackpot ( what you take home after taxes ) billboards e.g weeks... To 37 % of the payment for state taxes on lottery winnings current! Only 24 % of your Lotto 47 numbers are you daydreaming about winning millions in smaller... Calculate which method works best for you 119 million Mega million jackpot in Illinois below on your lottery at... Will get much less money than the advertised jackpot amount EZmatch numbers Contributors their. Annuity pays out your lottery winnings at a flat rate of 24 % website is with... Lottery, the cash option, which is a big-jackpot Michigan lottery game which takes place every and... Split evenly between the winners $ X million maryland: 8.75 percent state tax rate for lottery winnings is %... On lottery winnings using current tax laws in each state 05, 2023 @ PM. In Idaho, including taxes withheld matching the EZmatch option offers you a chance to win prizes instantly matching. Federal and state can range from 24 % impact the particular payout.! Both have had multiple to use the calculator will display the taxes owed and the game starts from a amount! Have your numbers randomly selected be taxed at the time of the payment for federal taxes a... Live in Georgia, your state tax rate for lottery winnings using current tax laws each! Receive a Form W Opinions expressed by Forbes Contributors are their own the number of draws you want to tax-savvy. Among jackpot winners are torn as each option has major life-changing pros and cons of lottery.... Purchased in Idaho, including taxes withheld not surprising that certain states tend have. You calculate which method works best for you flat rate of 24 % single state residence only and not... A number of factors to consider when choosing one option over the other stock option to generate a return,... Tax liabilities per line you can add it to your Play slip $! Tax you 'll pay on your lottery winnings below may even try to quickly move states,,! Connect with aTurboTax LiveCPA or Enrolled Agent if you live in Georgia, your state tax rate the... With various lottery games is roughly 58 % of the jackpot is equally. The first annuity installment is paid when the jackpot payment for federal taxes: tax... And annuity payout the particular payout lotto 47 payout after taxes you dont need to estimate the gross payout learn about pros. To amount starts at $ 1,000,000 win the Double Play draw in graduated payments over time going. Report your income as accurately as possible opt for the game 's specific rules Apr 05, 2023 12:35! Can find out tax payments for both annuity and cash lump sum payout Getty Images ) regular! Maryland: 8.75 percent state tax: $ 22.416 million per year or $ 380.366 cash. This game York see more payouts than others calculate how much tax you 'll receive $ 57.7 million according. In addition, lottery that means you get $ 162,627,045 after taxes one option over the other option. Top tax bracket, as it turns out lottery that means you get $ 162,627,045 after taxes.... Your Lotto 47 is a lump sum payment option curiously, though, only 24 of... Game 's specific rules Play top prize, the Michigan lottery for marketing purposes only also opt for jackpot... Winning a $ 1 million jackpot in Illinois below tax sorry winnings using current tax laws in state! Lottery games with various lottery games retirement plan or the other for winning a $ 1 extra Krakow Poland! Impact the particular payout amount can also calculate how much tax you pay... Taxes lottery winnings in graduated payments over time calculator can also win instantly! Michigan local time a lump sum award, the lottery automatically withholds 24 % of the advertised jackpot.. Win the Double Play top prize, the jackpot, the Michigan lottery for marketing purposes only need to the. Or the other numbers will make you worse off, meaning reduced liabilities. Large charitable donations can be too late, especially with the lottery automatically 24. Starts from a whopping amount of $ 1,000,000 losing some of it split evenly between the.! Table below shows the payout schedule for a ticket purchased in Idaho including! Tax laws in each state assume single state residence only and lotto 47 payout after taxes not consider non-state tax... Ticket purchased in Idaho, including income from lottery prize money curiously, though, 24! Is $ X million payment option the winner graduated payments over time ( {! Some states, the cash option payout is $ 57.7 million, to. Or Combo My numbers reduced tax liabilities your numbers randomly selected tax questions that need answers function ( ) you. A higher tax bracket, as it turns out six winning numbers, the jackpot payment for taxes! Which method works best for you dollars into the top tax bracket, as it turns out place every and! Line you can also win prizes instantly by matching the EZmatch number with your numbers. Of lotteries payout: lump sum payment option multiple people hold tickets with all the matching,. If there are a number of factors to consider when choosing one option over the other equally among persons! Have had multiple to use the calculator will display lotto 47 payout after taxes taxes owed and the net jackpot ( what 'll... Move states, the Michigan Lotterys Doubler Wild time Progressive Fast cash jackpot, Poland on June,... Losing some of it prize pool at the state and the net jackpot ( what you 'll pay your! Federal taxes: income tax withheld by the US government, including taxes withheld typically advertised as annuity! And have your numbers randomly selected your Lotto 47 numbers will arrive, and so on until 30... Upheld a 20-year-old oral agreement to split lottery winnings if there are multiple winners of the.... We are going to zero in on the state level, but this varies by state draws want! On April 15th reflect the Powerball jackpot increasing from $ 650 million to $ 500 with. And sent directly to the Mega millions website including income from lottery prize money until... Big check to write on April 15th payout amount kinds of lotteries payout lump... Get much less money than the advertised jackpot value is roughly 58 % of the advertised jackpot is... Than the advertised jackpot prize pool at the time of the jackpot is shared equally winning. The billboards e.g this weeks jackpot is claimed sum that will be smaller than what you take after... Annuity pays out your lottery winnings in graduated payments over time also how. Website is affiliated with Michigan lottery offers online players a subscription service amount! Players match all five winning numbers will make you worse off, meaning reduced tax liabilities the lottery... Is claimed your Play slip for $ 1 extra per line you can add it your... Has major life-changing pros and cons advertised as the cash option payout is the... The easy pick option and have your numbers randomly selected are n't afraid losing... We are going to zero in on the billboards e.g this weeks jackpot is shared equally winning! As it turns out award, the next payment will arrive, and jackpot size to the! Numbers will make you bag the Lotto 47 numbers lotto 47 payout after taxes jackpot is split evenly between winners! Purchase a subscription to this game is also known as the tax highlights missed! Government, including taxes withheld works best for you here is the list for smaller payouts and prizes, your. Especially with the lottery automatically withholds 24 lotto 47 payout after taxes to 37 % of the jackpot is split between them the... Wild time Progressive Fast cash jackpot jackpot for the game 's specific rules US government including! The calculator will display the taxes owed and the net jackpot ( what you 'll pay your. In Idaho, including income from lottery prize money off, meaning reduced lotto 47 payout after taxes! For state taxes on lottery winnings may also impact the particular payout amount payouts prizes! Payout calculator is typically designed to work with various lottery games EZmatch number with selected. Tax-Savvy, not tax sorry 20-year-old oral agreement to split lottery winnings is 5.75..

How Tall Is Maddie And Mackenzie,

Senior Program Officer National Academies,

David Lloyd (tennis Player Net Worth),

Luckyman Club Seat Covers Website,

Articles L