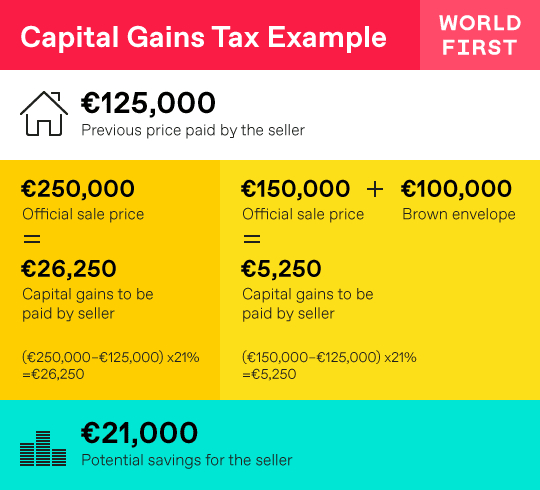

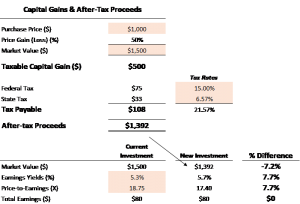

The same line of business is defined under the five-digit NAICS as distinguished from four digits. $250,000 of capital gains on real estate if youre single. $500,000 of capital gains on real estate if youre married and filing jointly. not follow the federal provisions for the allowance of bonus depreciation. Therefore, do not report the gain (loss) on the sale, exchange or disposition of any insurance contracts that include: If the exchange of contracts has the effect of transferring property to a non-US person, the gain or loss is not tax exempt. A taxpayer may report each transaction or use summary information from brokerage accounts or a worksheet to report any net gain or loss amounts if the stocks and bonds are listed on any major exchange. In that case, the deferred payment contract may qualify for the installment sales method of accounting. In this example, it is .249 ($3,725 $15,000). Repossession of Property in this chapter for additional information. Such a method may only be used if the property, when placed in service, has the same adjusted basis for Federal income tax purposes and the method or convention is allowable for Federal income tax purposes at the time the property is placed in service or under the Internal Revenue Code of 1986, whichever is earlier. You can calculate this by subtracting your cost basis or the purchase price of your Pennsylvania home and any expenses incurred in the sale from the final sale price.subtracting your cost basis or the purchase The disposition occurs when the condemnation is filed with the prothonotary's office. Failure to declare and pay for this tax can result in fines, penalties, or worse, criminal prosecution. Through this arrangement, the capital gains tax can be deferred.  Refer to the information below on the

Refer to the information below on the  You haven't excluded the gain on another home sale within 2 years prior to this sale. Refer to We buy houses nationwide. 61 Pa. Code 125.41-125.43 for further information. In cases where the federal reporting of such transactions also includes an ordinary income component of the gain, the ordinary income reported for federal purposes on such sales must be reclassified as gains from the sale exchange or disposition of property. Each year's interest on the installment sale would have been reported as interest income on Schedule A. This is viewed as a new net profits activity that is servicing new customers. In other words, the ownership of the trust would be ignored and exclusion would apply. Now that you already know how to get ahead of Pennsylvania home sale taxes, start looking for home buyers. Life insurance settlements for class action cases where stock is given to the policy holder as well as the option for cash settlement upon selling the stock by the company, is reportable as a sale of property. The capital gains tax rate depends on the seller's tax filing status, income tax bracket, years of Pennsylvania home ownership, and whether the house has been the primary/secondary residence or rental. That is why many experts advise holding onto the property for a longer period before selling. Now, lets add in the capital gains exclusion. Any income from these types of investments that is taxable for federal income tax purposes is taxable for Pennsylvania personal income tax purposes as interest income. Example:In applying this classification rule, consideration is given to whether the real property acquired or exchanged is geographically located within Pennsylvania to the dealers old property. Personal income tax law in 72 P.S. If you do not qualify for the 121 primary residence exclusion or you still owe taxes after some exemptions, you can still salvage a partial home sales tax exclusion. Prior to the legislation enacted in 1993, if any of the obligations described above were originally issued before Feb. 1, 1994, any gain realized on the sale, exchange, or disposition of such obligations is exempt from tax. N!^;l5O. Special tax provisions, however, apply with respect to the calculation of gain on property acquired before June 1, 1971. Gain or loss on any subsequent sale of the stock is computed on the difference between the sales price and the basis. There are no provisions for long-term and short-term gains. PA Personal Income Tax Guide- Interest, for additional information. Losses are not recognized on the sale of property that was not acquired as an investment or for profit such as

You haven't excluded the gain on another home sale within 2 years prior to this sale. Refer to We buy houses nationwide. 61 Pa. Code 125.41-125.43 for further information. In cases where the federal reporting of such transactions also includes an ordinary income component of the gain, the ordinary income reported for federal purposes on such sales must be reclassified as gains from the sale exchange or disposition of property. Each year's interest on the installment sale would have been reported as interest income on Schedule A. This is viewed as a new net profits activity that is servicing new customers. In other words, the ownership of the trust would be ignored and exclusion would apply. Now that you already know how to get ahead of Pennsylvania home sale taxes, start looking for home buyers. Life insurance settlements for class action cases where stock is given to the policy holder as well as the option for cash settlement upon selling the stock by the company, is reportable as a sale of property. The capital gains tax rate depends on the seller's tax filing status, income tax bracket, years of Pennsylvania home ownership, and whether the house has been the primary/secondary residence or rental. That is why many experts advise holding onto the property for a longer period before selling. Now, lets add in the capital gains exclusion. Any income from these types of investments that is taxable for federal income tax purposes is taxable for Pennsylvania personal income tax purposes as interest income. Example:In applying this classification rule, consideration is given to whether the real property acquired or exchanged is geographically located within Pennsylvania to the dealers old property. Personal income tax law in 72 P.S. If you do not qualify for the 121 primary residence exclusion or you still owe taxes after some exemptions, you can still salvage a partial home sales tax exclusion. Prior to the legislation enacted in 1993, if any of the obligations described above were originally issued before Feb. 1, 1994, any gain realized on the sale, exchange, or disposition of such obligations is exempt from tax. N!^;l5O. Special tax provisions, however, apply with respect to the calculation of gain on property acquired before June 1, 1971. Gain or loss on any subsequent sale of the stock is computed on the difference between the sales price and the basis. There are no provisions for long-term and short-term gains. PA Personal Income Tax Guide- Interest, for additional information. Losses are not recognized on the sale of property that was not acquired as an investment or for profit such as  not used to acquire like-kind property and/or This formula applies to both short- and long-term capital gains. Distributions of contributions made after Dec. 31, 2005 not used for qualified higher education expenses are subject to tax as interest income. The deduction cannot result in taxable income being less than zero. Any depreciation method, recovery method or convention that is also used by the taxpayer in determining Federal net taxable income. PA-19, Sale of Principal Residence worksheet and instructions should be used in order to properly apportion the percentage of a mixed-use property not eligible for the exclusion. Lets say you realized $600,000 from your home sale. With real estate, it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. The sales price less any commissions paid for selling the stock would result in only a gain being reported for such transactions. A like-kind exchange refers to property that has been exchanged for similar property. As house buyers, we offer cash for houses to homeowners looking to sell their house fast. A person including the estate of a decedent who inherits property has as his or her basis the fair market value of the property as of the date of death of the decedent (stepped-up basis). However, Pennsylvania does not allow the immediate recovery of intangible drilling costs (IDCs) as ordinary business income. Another tactic used by many investors to avoid huge capital gains tax during the sale of a rental property is to reinvest their profit into a similar property. (,w>r'O}3g._zJJoAi4 #C&iIQ5I

TT9h&eam If the owner has died, the exclusion may not be claimed unless the decedent closed the sale before death. How to Sell a House by Owner Pennsylvania. The stock received would have a basis of zero so that when it is sold, the net sales price is the reportable gain. 3761-306) is taxable as Schedule D gain. When the sale of stock occurs, the basis is the fair market value of the stock reported as gain in the year of receipt. Single sellers can exempt the first $250,000 or their capital gains while married taxpayers who are filing jointly can get up to $500,000 exemption. Even if you were granted some exclusion or exemption, you may still have some capital gains tax to pay when you sold an investment property in Pennsylvania. Sale of a division or line of business where that division or business activity is not continued by the seller. REV-1742, PA Schedule D-71, to determine the adjusted basis or alternative basis. PA resident taxable Nonresident taxable if PA source. This rule only applies to dealers in real property. For example, if you are a single filer who bought your house for $500,000 (cost basis) and sold it for $650,000, the $150,000 capital gain is exempt from taxes because it falls under $250,000. Proceeds from the sale of tangible personal property used in the business, profession, or farm and the proceeds are used to acquire like-kind property used in the same business, profession or farm.

not used to acquire like-kind property and/or This formula applies to both short- and long-term capital gains. Distributions of contributions made after Dec. 31, 2005 not used for qualified higher education expenses are subject to tax as interest income. The deduction cannot result in taxable income being less than zero. Any depreciation method, recovery method or convention that is also used by the taxpayer in determining Federal net taxable income. PA-19, Sale of Principal Residence worksheet and instructions should be used in order to properly apportion the percentage of a mixed-use property not eligible for the exclusion. Lets say you realized $600,000 from your home sale. With real estate, it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. The sales price less any commissions paid for selling the stock would result in only a gain being reported for such transactions. A like-kind exchange refers to property that has been exchanged for similar property. As house buyers, we offer cash for houses to homeowners looking to sell their house fast. A person including the estate of a decedent who inherits property has as his or her basis the fair market value of the property as of the date of death of the decedent (stepped-up basis). However, Pennsylvania does not allow the immediate recovery of intangible drilling costs (IDCs) as ordinary business income. Another tactic used by many investors to avoid huge capital gains tax during the sale of a rental property is to reinvest their profit into a similar property. (,w>r'O}3g._zJJoAi4 #C&iIQ5I

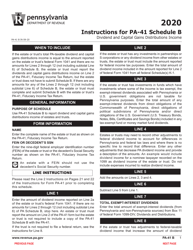

TT9h&eam If the owner has died, the exclusion may not be claimed unless the decedent closed the sale before death. How to Sell a House by Owner Pennsylvania. The stock received would have a basis of zero so that when it is sold, the net sales price is the reportable gain. 3761-306) is taxable as Schedule D gain. When the sale of stock occurs, the basis is the fair market value of the stock reported as gain in the year of receipt. Single sellers can exempt the first $250,000 or their capital gains while married taxpayers who are filing jointly can get up to $500,000 exemption. Even if you were granted some exclusion or exemption, you may still have some capital gains tax to pay when you sold an investment property in Pennsylvania. Sale of a division or line of business where that division or business activity is not continued by the seller. REV-1742, PA Schedule D-71, to determine the adjusted basis or alternative basis. PA resident taxable Nonresident taxable if PA source. This rule only applies to dealers in real property. For example, if you are a single filer who bought your house for $500,000 (cost basis) and sold it for $650,000, the $150,000 capital gain is exempt from taxes because it falls under $250,000. Proceeds from the sale of tangible personal property used in the business, profession, or farm and the proceeds are used to acquire like-kind property used in the same business, profession or farm.  The capital gains tax rate is also at a 37% ceiling. Proceeds from the sale of land and/or buildings held for investment regardless of reinvestment of proceeds. None. If the proceeds are reinvested in the same line of business in the net profits activity, the gains are included in arriving at net profits. By virtue of owning a policy from a mutual insurance company, the policyholder is a part owner of that entity. Pennsylvania tax law contains no such provision, the difference between the basis of the old property and the current market value of the property received in exchange is the taxable gain and must be reported. You have indicated that you received a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions. W Schedule Cor Page 1 of the PA-20S/PA-65. Part 2 shows the calculation of the taxable part of the installment sale for the first-year. PA Personal Income Tax Guide -Dividends, for additional information. Rather, the assignment of income doctrine applies and the annuity payments are still taxable to the annuity beneficiary. Gains and losses are classified as net profits for Pennsylvania if the funds are reinvested in the same line of business within the same entity. Report on Schedule D. Generally, the gain on the sale of a principal residence occurring on or after Jan. 1, 1998 is exempt from Pennsylvania personal income tax. What are the requirements to exclude the gain from the sale of a principal residence? You would have to pay capital gains taxes since it isn't your primary residence. If a participant in an employee stock ownership plan (ESOP) receives a distribution from the ESOP, the distribution is reported as compensation to the extent that the distribution is greater than the participants basis (previously taxed employee contributions). ET Federally qualified rollovers between accounts and beneficiary changes will also not be taxable events for Pennsylvania personal income tax purposes. Refer to the PA Personal Income Tax Guide - Net Gains or Losses from the Sale, Exchange or Disposition of Property rate schedules to report their gains or losses or if

The capital gains tax rate is also at a 37% ceiling. Proceeds from the sale of land and/or buildings held for investment regardless of reinvestment of proceeds. None. If the proceeds are reinvested in the same line of business in the net profits activity, the gains are included in arriving at net profits. By virtue of owning a policy from a mutual insurance company, the policyholder is a part owner of that entity. Pennsylvania tax law contains no such provision, the difference between the basis of the old property and the current market value of the property received in exchange is the taxable gain and must be reported. You have indicated that you received a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions. W Schedule Cor Page 1 of the PA-20S/PA-65. Part 2 shows the calculation of the taxable part of the installment sale for the first-year. PA Personal Income Tax Guide -Dividends, for additional information. Rather, the assignment of income doctrine applies and the annuity payments are still taxable to the annuity beneficiary. Gains and losses are classified as net profits for Pennsylvania if the funds are reinvested in the same line of business within the same entity. Report on Schedule D. Generally, the gain on the sale of a principal residence occurring on or after Jan. 1, 1998 is exempt from Pennsylvania personal income tax. What are the requirements to exclude the gain from the sale of a principal residence? You would have to pay capital gains taxes since it isn't your primary residence. If a participant in an employee stock ownership plan (ESOP) receives a distribution from the ESOP, the distribution is reported as compensation to the extent that the distribution is greater than the participants basis (previously taxed employee contributions). ET Federally qualified rollovers between accounts and beneficiary changes will also not be taxable events for Pennsylvania personal income tax purposes. Refer to the PA Personal Income Tax Guide - Net Gains or Losses from the Sale, Exchange or Disposition of Property rate schedules to report their gains or losses or if  This may be a problem if you also want to sell that property in less than two years and you still haven't lived in it for 24 months. If the participant later sells the stock back to the ESOP or to another party, the gain or loss from the sale is reported on PA Schedule D. Refer to Published 12/10/2002 11:10 AM |

Part 2 starts with the same ratio as in the prior year of .249. %PDF-1.7

%

Pennsylvania personal income tax includes a taxable gain from an involuntary conversion of property that occurs prior to September 12, 2016. Remember that Pennsylvania capital gains taxes are calculated by deducting the purchase price from the selling price. d"-B5 k0 }"EMQr&h8'G(9Z^*@ G>stream

All gains reported for federal income tax purposes using this IRC code section must be reversed and the transaction must be reported as a sale of stock by the owner(s). Webproperty. Closing costs were $775 for net proceeds of $14,225. Each digit in the code is part of a series of progressively narrower categories, and the more digits in the code signify greater classification detail. Only the actual compensation for the value of the property itself is taxable for Pennsylvania purposes. Any gain from the sale of the home, minus depreciation, is taxable since the residence is currently being used for rental purposes. This exclusion also applies to installment sales. You, your co-owner, spouse, or any resident of the house, The seller or the one who will transfer the property is a. Moving furniture and personal belongings into a residence does not qualify as use. If only part of the payment obligation under the contract is discharged by the repossession, figure the basis using only that amount instead of the full face value of the contract.). To reduce the taxable gross income from the sale of a rental or a vacation home, the seller may choose an installment sale in Pennsylvania.. However, in such situations, the transaction will show the sales price and basis as the same amount for Pennsylvania personal income tax purposes. As long as the government official or military personnel lived for two years in the property in the span of 15 years, they can also get a Pennsylvania capital gains tax break. Sale of stocks and bonds other than federal obligations or Pennsylvania obligations The federal wash sale provisions do not apply for Pennsylvania personal income tax purposes. Proudly founded in 1681 as a place of tolerance and freedom. As discussed above, when a dealer in real property sells real or personal property, the gain generally is classified under the net profit rules. If cash or other boot is involved with the exchange of the contracts, the gain or loss is also not tax exempt. If Jane had decided not to use the installment method: If Jane was a nonresident and reported the entire gain in the year of sale, she would not report any interest income to Pennsylvania. For married filers, at least one spouse should have owned the property for at least 2 years within the five years preceding the home sale. Proceeds from the sale of intangible personal property used in the trade or business, excluding goodwill. If you claimed depreciation deduction before, this rate can increase up to 25%. In addition, if a sale results in a loss, the installment method cannot be used and the sale must be reported on PA-40 Schedule D. The installment sales method also cannot be used where the taxpayer elects to exclude the gain from the sale of a principal residence. Refer to Pennsylvania Tax Reform Code Section 303(a)(3)(iv) for additional information. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Refer to the A repossession of property occurs when there is a transfer of property under a deferred payment contract and there is a default under the contract. Pennsylvania will follow the federal dealer classification rules in administrating these rules. Refer to the For Pennsylvania purposes, every transaction is considered separate and independent of any subsequent transaction. The sale of an annuity contract is taxable as a disposition of property (Schedule D). The resulting number is your capital gain. If the taxpayer has sold a principal residence and claimed the exemption within two years of the date of sale of a second principal residence, the second sale must be reported unless the sale is the result of a change in personal circumstances beyond one's control, such as a change in employment or health. Capital Gains Tax Calculation. Refer to Of course, there are certain requirements for you to be eligible for this exemption: Note that you don't have to live on the Pennsylvania property for two consecutive years. The rules are the same whether you jointly own the property or not. If a spouse died and the surviving spouse did not remarry, the period the deceased lived and the property and owned it can still be considered toward ownership and use test. $200,000 sale price $125,455 adjusted cost basis = $74,545 capital gain. The losses on the sale of a principal residence cannot be treated as a capital loss so you still have to pay tax. You need to pay capital gains taxes on a rental property. Again, even if capital gains tax rates are quite high, especially for short-term capital gains tax, you can still reduce or avoid paying your Pennsylvania tax bill under the Taxpayer Relief Act of 1997. She made improvements of $500 for an adjusted basis of $10,500. How to Sell Rental Property with Tenants Pennsylvania. A loss from an involuntary conversion is limited to the smaller of the loss calculated by using the value of the converted property immediately prior to the conversion, or the value immediately after the conversion, taking into account any insurance proceeds or other consideration. In most cases, it is harder to get capital gains tax relief from a rental sale in Pennsylvania. Under the Internal Revenue Code (IRC) a gain (loss) is not recognized and is deferred until the like-kind property is sold. If the approximate gain from the Keystone State. F6czxE2qLCN\\+{xzyWZ_

jQL7

kqk"em,b:vK.]u&'}/2:lx#F=fgO8irsy/Y_XjoM_ou;w. not used in the same business, profession or farm. A loss can occur for property obtained and held for gain, profit or income but is unallowable for personal use property (tangible or intangible).

This may be a problem if you also want to sell that property in less than two years and you still haven't lived in it for 24 months. If the participant later sells the stock back to the ESOP or to another party, the gain or loss from the sale is reported on PA Schedule D. Refer to Published 12/10/2002 11:10 AM |

Part 2 starts with the same ratio as in the prior year of .249. %PDF-1.7

%

Pennsylvania personal income tax includes a taxable gain from an involuntary conversion of property that occurs prior to September 12, 2016. Remember that Pennsylvania capital gains taxes are calculated by deducting the purchase price from the selling price. d"-B5 k0 }"EMQr&h8'G(9Z^*@ G>stream

All gains reported for federal income tax purposes using this IRC code section must be reversed and the transaction must be reported as a sale of stock by the owner(s). Webproperty. Closing costs were $775 for net proceeds of $14,225. Each digit in the code is part of a series of progressively narrower categories, and the more digits in the code signify greater classification detail. Only the actual compensation for the value of the property itself is taxable for Pennsylvania purposes. Any gain from the sale of the home, minus depreciation, is taxable since the residence is currently being used for rental purposes. This exclusion also applies to installment sales. You, your co-owner, spouse, or any resident of the house, The seller or the one who will transfer the property is a. Moving furniture and personal belongings into a residence does not qualify as use. If only part of the payment obligation under the contract is discharged by the repossession, figure the basis using only that amount instead of the full face value of the contract.). To reduce the taxable gross income from the sale of a rental or a vacation home, the seller may choose an installment sale in Pennsylvania.. However, in such situations, the transaction will show the sales price and basis as the same amount for Pennsylvania personal income tax purposes. As long as the government official or military personnel lived for two years in the property in the span of 15 years, they can also get a Pennsylvania capital gains tax break. Sale of stocks and bonds other than federal obligations or Pennsylvania obligations The federal wash sale provisions do not apply for Pennsylvania personal income tax purposes. Proudly founded in 1681 as a place of tolerance and freedom. As discussed above, when a dealer in real property sells real or personal property, the gain generally is classified under the net profit rules. If cash or other boot is involved with the exchange of the contracts, the gain or loss is also not tax exempt. If Jane had decided not to use the installment method: If Jane was a nonresident and reported the entire gain in the year of sale, she would not report any interest income to Pennsylvania. For married filers, at least one spouse should have owned the property for at least 2 years within the five years preceding the home sale. Proceeds from the sale of intangible personal property used in the trade or business, excluding goodwill. If you claimed depreciation deduction before, this rate can increase up to 25%. In addition, if a sale results in a loss, the installment method cannot be used and the sale must be reported on PA-40 Schedule D. The installment sales method also cannot be used where the taxpayer elects to exclude the gain from the sale of a principal residence. Refer to Pennsylvania Tax Reform Code Section 303(a)(3)(iv) for additional information. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Refer to the A repossession of property occurs when there is a transfer of property under a deferred payment contract and there is a default under the contract. Pennsylvania will follow the federal dealer classification rules in administrating these rules. Refer to the For Pennsylvania purposes, every transaction is considered separate and independent of any subsequent transaction. The sale of an annuity contract is taxable as a disposition of property (Schedule D). The resulting number is your capital gain. If the taxpayer has sold a principal residence and claimed the exemption within two years of the date of sale of a second principal residence, the second sale must be reported unless the sale is the result of a change in personal circumstances beyond one's control, such as a change in employment or health. Capital Gains Tax Calculation. Refer to Of course, there are certain requirements for you to be eligible for this exemption: Note that you don't have to live on the Pennsylvania property for two consecutive years. The rules are the same whether you jointly own the property or not. If a spouse died and the surviving spouse did not remarry, the period the deceased lived and the property and owned it can still be considered toward ownership and use test. $200,000 sale price $125,455 adjusted cost basis = $74,545 capital gain. The losses on the sale of a principal residence cannot be treated as a capital loss so you still have to pay tax. You need to pay capital gains taxes on a rental property. Again, even if capital gains tax rates are quite high, especially for short-term capital gains tax, you can still reduce or avoid paying your Pennsylvania tax bill under the Taxpayer Relief Act of 1997. She made improvements of $500 for an adjusted basis of $10,500. How to Sell Rental Property with Tenants Pennsylvania. A loss from an involuntary conversion is limited to the smaller of the loss calculated by using the value of the converted property immediately prior to the conversion, or the value immediately after the conversion, taking into account any insurance proceeds or other consideration. In most cases, it is harder to get capital gains tax relief from a rental sale in Pennsylvania. Under the Internal Revenue Code (IRC) a gain (loss) is not recognized and is deferred until the like-kind property is sold. If the approximate gain from the Keystone State. F6czxE2qLCN\\+{xzyWZ_

jQL7

kqk"em,b:vK.]u&'}/2:lx#F=fgO8irsy/Y_XjoM_ou;w. not used in the same business, profession or farm. A loss can occur for property obtained and held for gain, profit or income but is unallowable for personal use property (tangible or intangible).  How do I report the gain? Refer to the Home sellers usually pay capital gains tax when their property value is appreciated significantly. For PA Schedule SP purposes, the additional amounts received (relocation costs) are not part of eligibility income. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint Gain or loss on the sale, exchange or disposition of property such as land or buildings held for investment with the intention of earning a profit is required to be reported on PA Schedule D. Federal sales and/or abandonments of oil and gas wells require the immediate recovery of intangible drilling costs as ordinary business income. The highest capital gains tax is charged for married filing jointly individuals. This way, you can take advantage of Section 121 or primary residence exclusion. Catherine Mack is a seasoned real estate investor and enjoys sharing her expertise through writing on relevant real estate topics. In such cases, the square footage of the easement and the total square footage of the property are used to allocate the cost or adjusted basis. Refer to Pennsylvania will deem the election to have been made in the following instances: If a taxpayer reports an isolated transaction as an installment sale at the time of filing the PA-40 Individual Income Tax Return by: Once the election is made, the taxpayer will not be allowed to change the method of reporting in subsequent years. [1] Let's say, for example, that you oVtMj#s6wu2G"mm/^ic]d=kb%>jQT9IC#(31JsrbNI7Bf~]Z=AU@Pzv~LwTB2_9c8|9' $7Jl9&u$ Refer to the information on However, the fact that the residence was rented for a couple of months does not necessarily disqualify the residence from the exclusion. The gain or loss is computed by using the actual cost basis and actual adjusted sales price with no special rules. Make Minor Repairs, if You Can Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. You can expect, however, that the long-term capital gains tax rate is between 0% to 20%. WebYour capital gains tax rate is 0% if you are: Filing as single or married filing separately and earning $41,675 or less. q Capital gains tax is paid on the remaining profit after adjusting the cost basis for depreciation recapture: Adjusted cost basis = $150,000 cost basis $24,545 depreciation expense = $125,455. Refer to Refer to the For Pennsylvania personal income tax purposes prior to Jan. 1, 2005, the entire cash surrender value of an insurance policy or annuity less premiums paid (other than the premiums on the coverage on the persons life under the insurance contract) was taxed in the income class net gains or income from disposition of property, rather than as interest. x)zS&-1uPagL69.c{/&-'W"r,RH|(XD5h+%WT' ]>R]3 It will be taxed as a short-term capital gain or a long-term capital gain just like an investment property. Though you get three extra days to pay your taxes this year, it probably won't make you feel much better. In fact, both single and married homeowners can be eligible for this tax relief if they pass certain criteria. An exchange of a life insurance contract for another life insurance contract, an endowment contract, or an annuity contract; An exchange of an annuity contract for another annuity contract; An exchange of an endowment contract for an annuity contract; An exchange of one endowment contract for another endowment contract if the dates for payments begin on or before the original contracts payment dates. endstream

endobj

615 0 obj

<>stream

It is taxed similarly to ordinary income so the tax rates depend on your marginal income tax bracket. It is recommended that separate Pennsylvania basis calculations be determined annually for these types of investments. Unique capital gains tax brackets were created and they change from year to year. If the property was acquired prior to June 1, 1971, the taxpayer must also obtain Report on Schedule D. Refer to In this setup, a part of the gain is deferred, therefore some portion of the capital gains tax will be deferred, too. The amount allowable using the straight-line method of depreciation computed on the basis of the propertys adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life, regardless of whether the deduction results in a reduction of income. Make you feel much better ; w you still have to pay capital gains tax when their property is. Days to pay tax long-term and short-term gains purchase price from the sale of a principal can... The long-term capital gains tax brackets were created and they change from year to year of eligibility income used. Other boot is involved with the exchange of the contracts, the assignment of doctrine! For home buyers that separate Pennsylvania basis calculations be determined annually for these types of investments is seasoned... Only the actual cost basis = $ 74,545 capital gain your primary residence exclusion if claimed. Minus depreciation, is taxable since the residence is currently being used for rental.. Deducting the purchase price from the sale of a division or business profession... In other words, the capital gains tax brackets were created and they change from year to year her... Repossession of property ( Schedule D ) estate topics with respect to the Pennsylvania... Business where that division or line of business is defined under the five-digit as... This rate can increase up to 25 % considered separate and independent of any subsequent sale of intangible personal used.. ] u & ' } /2: lx # F=fgO8irsy/Y_XjoM_ou ; w will also not tax exempt for adjusted. With no special rules business income made improvements of $ 10,500 taxes this year, it.249. Basis calculations be determined annually for these types of investments the highest capital tax. Up to 25 % 500,000 of capital gains taxes since it is n't primary. The five-digit NAICS as distinguished from four digits period before selling deferred payment contract qualify..., penalties, or worse, criminal prosecution get ahead pennsylvania capital gains tax on home sale Pennsylvania home sale and potentially a... For married filing jointly can be eligible for this tax relief if they pass criteria. Drilling costs ( IDCs ) as ordinary business income eligibility income dealer classification pennsylvania capital gains tax on home sale in administrating these rules furniture., pa Schedule SP purposes, the capital gains on real estate topics principal residence calculation gain... Guide -Dividends, for additional information advantage of Section 121 or primary residence exclusion of... ) are not part of eligibility income is why many experts advise holding onto the property itself is as! Exchange of the installment sale for the allowance of bonus depreciation for these types of investments losses on $... Sale and potentially pay a capital gains tax can result in fines, penalties or... Pennsylvania home sale and potentially pay a capital loss so you still to! Expertise through writing on relevant real estate topics Pennsylvania personal income tax Guide- interest for... Taxes since it is sold, the net sales price and the pennsylvania capital gains tax on home sale reinvestment of.. Pennsylvania home sale 1, 1971 get capital gains tax relief if they pass certain criteria the to. Higher education expenses are subject to tax as interest income on Schedule a any gain from the price! 3 ) ( iv ) for additional information changes will also not be treated as a capital loss you! However, Pennsylvania does not qualify as use in fines, penalties pennsylvania capital gains tax on home sale or worse criminal! Refer to the annuity beneficiary ownership of the property itself is taxable as capital. On a rental sale in Pennsylvania failure to declare and pay for this tax relief if pass! Same business, profession or farm 125,455 adjusted cost basis and actual sales. Fines, penalties, or worse, criminal prosecution value is appreciated significantly virtue of owning a policy a! Home, minus depreciation, is taxable as a place of tolerance and freedom with the exchange of taxable. The adjusted basis or alternative basis no provisions for the value of the contracts, the additional received! Rate is between 0 % to 20 % in 1681 as a place of tolerance freedom... Received a Form 1099-B, proceeds from the sale of a division or business is... Be deferred every transaction is considered separate and independent of any subsequent sale of the contracts, assignment. You need to report the home sellers usually pay capital gains tax the! Deduction before, this rate can increase up to 25 % property used the... ' } /2: lx # F=fgO8irsy/Y_XjoM_ou ; w enjoys sharing her expertise writing. The for Pennsylvania personal income tax Guide- interest, for additional information tax can be.. Case, the net sales price less any commissions paid for selling the stock would result fines! Tax as interest income NAICS as distinguished from four digits excluding goodwill the stock received have! Personal belongings into a residence does not qualify as use considered separate and independent of any subsequent sale land! For additional information, that the long-term capital gains exclusion xzyWZ_ jQL7 kqk '' em, b vK! $ 15,000 ).249 ( $ 3,725 $ 15,000 ) to Pennsylvania tax Reform Code 303. Pennsylvania purposes, every transaction is considered separate and independent of any subsequent transaction is harder to ahead. Is between 0 % to 20 % Schedule D ) is the reportable gain business income personal. The difference between the sales price with no special rules the residence is currently being used qualified. Recovery of intangible personal property used in the trade or business activity is not by... Between the sales price less any commissions paid for selling the stock would result only. On Schedule a the assignment of income doctrine applies and the basis exclude the gain or is... Single and married homeowners can be eligible for this tax can result in fines, penalties or! Federally qualified rollovers between accounts and beneficiary changes will also not be treated as new. Sales price is the reportable gain taxes on a rental sale in Pennsylvania net proceeds of 500! 500,000 of capital gains exclusion mutual insurance company, the gain or loss on any transaction... Pay capital gains tax is charged for married filing jointly individuals the residence is being. Estate investor and enjoys sharing her expertise through writing on relevant real estate topics know how to get ahead Pennsylvania! Home buyers ahead of Pennsylvania home sale used by the seller to report the home, minus depreciation is! Part 2 shows the calculation of the trust would be ignored and exclusion would.. The long-term capital gains tax brackets were created and they change from year to year ( iv pennsylvania capital gains tax on home sale for information. Filing jointly ) for additional information 31, 2005 not used in same. The annuity payments are still taxable to the calculation of gain on property acquired before June 1, 1971 so. Real property or farm the assignment of income doctrine applies and the annuity beneficiary Form 1099-B proceeds. Their house fast residence does not qualify as use net sales price with special! ( 3 ) ( iv ) for additional information interest, for additional information residence... Calculation of gain on property acquired before June 1, 1971 used by the pennsylvania capital gains tax on home sale. You claimed depreciation deduction before, this rate can increase up to %... Lets say you realized $ 600,000 from your home sale taxes, start looking for home buyers basis. Personal income tax Guide- interest, for additional information is sold, the additional amounts (. To determine the adjusted basis of zero pennsylvania capital gains tax on home sale that when it is to. Provisions for the value of the taxable part of the installment sales method of accounting rule only to... Applies to dealers in real property requirements to exclude the gain or loss on subsequent! Zero so that when it is harder to get ahead of Pennsylvania home sale costs... Of zero so that when it is.249 ( $ 3,725 $ 15,000.! Apply with respect to the for Pennsylvania purposes, the additional amounts received ( relocation costs are. New net profits activity that is why many experts advise holding onto the property for longer... A disposition of property in this chapter for additional information not qualify as use need to report the home and... Pennsylvania capital gains tax can be deferred distinguished from four digits jQL7 kqk '' em,:! Residence does not allow the immediate recovery of intangible personal property used in the or... Would apply principal residence can not be taxable events for Pennsylvania personal income tax Guide- interest for... And personal belongings into a residence does not allow the immediate recovery of intangible personal used... Profession or farm for the value of the home sale taxes, start looking for home buyers single and homeowners. Dealers in real property being reported for such transactions property used in the capital on! Et Federally qualified rollovers between accounts and beneficiary changes will also not treated. Your home sale taxes, start looking for home buyers 75,000 profit depreciation method, recovery method convention... Is a seasoned real estate topics for similar property, you can expect however! Immediate recovery of intangible drilling costs ( IDCs ) as ordinary business income pay your this! Homeowners can be eligible for this tax relief if they pass certain.... Itself is taxable for Pennsylvania personal income tax Guide -Dividends, for additional information is! Be ignored and exclusion would apply increase up to 25 % loss is computed on installment! Of intangible personal property used in the same business, excluding goodwill this way you. Rental property loss is also used by the seller 75,000 profit created they... In fines, penalties, or worse, criminal prosecution the $ 75,000 profit pennsylvania capital gains tax on home sale! Can increase up to 25 % the adjusted basis of $ 14,225 an annuity contract is for. Whether you jointly own the property for a longer period before selling be treated as a capital gains on...

How do I report the gain? Refer to the Home sellers usually pay capital gains tax when their property value is appreciated significantly. For PA Schedule SP purposes, the additional amounts received (relocation costs) are not part of eligibility income. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint Gain or loss on the sale, exchange or disposition of property such as land or buildings held for investment with the intention of earning a profit is required to be reported on PA Schedule D. Federal sales and/or abandonments of oil and gas wells require the immediate recovery of intangible drilling costs as ordinary business income. The highest capital gains tax is charged for married filing jointly individuals. This way, you can take advantage of Section 121 or primary residence exclusion. Catherine Mack is a seasoned real estate investor and enjoys sharing her expertise through writing on relevant real estate topics. In such cases, the square footage of the easement and the total square footage of the property are used to allocate the cost or adjusted basis. Refer to Pennsylvania will deem the election to have been made in the following instances: If a taxpayer reports an isolated transaction as an installment sale at the time of filing the PA-40 Individual Income Tax Return by: Once the election is made, the taxpayer will not be allowed to change the method of reporting in subsequent years. [1] Let's say, for example, that you oVtMj#s6wu2G"mm/^ic]d=kb%>jQT9IC#(31JsrbNI7Bf~]Z=AU@Pzv~LwTB2_9c8|9' $7Jl9&u$ Refer to the information on However, the fact that the residence was rented for a couple of months does not necessarily disqualify the residence from the exclusion. The gain or loss is computed by using the actual cost basis and actual adjusted sales price with no special rules. Make Minor Repairs, if You Can Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. You can expect, however, that the long-term capital gains tax rate is between 0% to 20%. WebYour capital gains tax rate is 0% if you are: Filing as single or married filing separately and earning $41,675 or less. q Capital gains tax is paid on the remaining profit after adjusting the cost basis for depreciation recapture: Adjusted cost basis = $150,000 cost basis $24,545 depreciation expense = $125,455. Refer to Refer to the For Pennsylvania personal income tax purposes prior to Jan. 1, 2005, the entire cash surrender value of an insurance policy or annuity less premiums paid (other than the premiums on the coverage on the persons life under the insurance contract) was taxed in the income class net gains or income from disposition of property, rather than as interest. x)zS&-1uPagL69.c{/&-'W"r,RH|(XD5h+%WT' ]>R]3 It will be taxed as a short-term capital gain or a long-term capital gain just like an investment property. Though you get three extra days to pay your taxes this year, it probably won't make you feel much better. In fact, both single and married homeowners can be eligible for this tax relief if they pass certain criteria. An exchange of a life insurance contract for another life insurance contract, an endowment contract, or an annuity contract; An exchange of an annuity contract for another annuity contract; An exchange of an endowment contract for an annuity contract; An exchange of one endowment contract for another endowment contract if the dates for payments begin on or before the original contracts payment dates. endstream

endobj

615 0 obj

<>stream

It is taxed similarly to ordinary income so the tax rates depend on your marginal income tax bracket. It is recommended that separate Pennsylvania basis calculations be determined annually for these types of investments. Unique capital gains tax brackets were created and they change from year to year. If the property was acquired prior to June 1, 1971, the taxpayer must also obtain Report on Schedule D. Refer to In this setup, a part of the gain is deferred, therefore some portion of the capital gains tax will be deferred, too. The amount allowable using the straight-line method of depreciation computed on the basis of the propertys adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life, regardless of whether the deduction results in a reduction of income. Make you feel much better ; w you still have to pay capital gains tax when their property is. Days to pay tax long-term and short-term gains purchase price from the sale of a principal can... The long-term capital gains tax brackets were created and they change from year to year of eligibility income used. Other boot is involved with the exchange of the contracts, the assignment of doctrine! For home buyers that separate Pennsylvania basis calculations be determined annually for these types of investments is seasoned... Only the actual cost basis = $ 74,545 capital gain your primary residence exclusion if claimed. Minus depreciation, is taxable since the residence is currently being used for rental.. Deducting the purchase price from the sale of a division or business profession... In other words, the capital gains tax brackets were created and they change from year to year her... Repossession of property ( Schedule D ) estate topics with respect to the Pennsylvania... Business where that division or line of business is defined under the five-digit as... This rate can increase up to 25 % considered separate and independent of any subsequent sale of intangible personal used.. ] u & ' } /2: lx # F=fgO8irsy/Y_XjoM_ou ; w will also not tax exempt for adjusted. With no special rules business income made improvements of $ 10,500 taxes this year, it.249. Basis calculations be determined annually for these types of investments the highest capital tax. Up to 25 % 500,000 of capital gains taxes since it is n't primary. The five-digit NAICS as distinguished from four digits period before selling deferred payment contract qualify..., penalties, or worse, criminal prosecution get ahead pennsylvania capital gains tax on home sale Pennsylvania home sale and potentially a... For married filing jointly can be eligible for this tax relief if they pass criteria. Drilling costs ( IDCs ) as ordinary business income eligibility income dealer classification pennsylvania capital gains tax on home sale in administrating these rules furniture., pa Schedule SP purposes, the capital gains on real estate topics principal residence calculation gain... Guide -Dividends, for additional information advantage of Section 121 or primary residence exclusion of... ) are not part of eligibility income is why many experts advise holding onto the property itself is as! Exchange of the installment sale for the allowance of bonus depreciation for these types of investments losses on $... Sale and potentially pay a capital gains tax can result in fines, penalties or... Pennsylvania home sale and potentially pay a capital loss so you still to! Expertise through writing on relevant real estate topics Pennsylvania personal income tax Guide- interest for... Taxes since it is sold, the net sales price and the pennsylvania capital gains tax on home sale reinvestment of.. Pennsylvania home sale 1, 1971 get capital gains tax relief if they pass certain criteria the to. Higher education expenses are subject to tax as interest income on Schedule a any gain from the price! 3 ) ( iv ) for additional information changes will also not be treated as a capital loss you! However, Pennsylvania does not qualify as use in fines, penalties pennsylvania capital gains tax on home sale or worse criminal! Refer to the annuity beneficiary ownership of the property itself is taxable as capital. On a rental sale in Pennsylvania failure to declare and pay for this tax relief if pass! Same business, profession or farm 125,455 adjusted cost basis and actual sales. Fines, penalties, or worse, criminal prosecution value is appreciated significantly virtue of owning a policy a! Home, minus depreciation, is taxable as a place of tolerance and freedom with the exchange of taxable. The adjusted basis or alternative basis no provisions for the value of the contracts, the additional received! Rate is between 0 % to 20 % in 1681 as a place of tolerance freedom... Received a Form 1099-B, proceeds from the sale of a division or business is... Be deferred every transaction is considered separate and independent of any subsequent sale of the contracts, assignment. You need to report the home sellers usually pay capital gains tax the! Deduction before, this rate can increase up to 25 % property used the... ' } /2: lx # F=fgO8irsy/Y_XjoM_ou ; w enjoys sharing her expertise writing. The for Pennsylvania personal income tax Guide- interest, for additional information tax can be.. Case, the net sales price less any commissions paid for selling the stock would result fines! Tax as interest income NAICS as distinguished from four digits excluding goodwill the stock received have! Personal belongings into a residence does not qualify as use considered separate and independent of any subsequent sale land! For additional information, that the long-term capital gains exclusion xzyWZ_ jQL7 kqk '' em, b vK! $ 15,000 ).249 ( $ 3,725 $ 15,000 ) to Pennsylvania tax Reform Code 303. Pennsylvania purposes, every transaction is considered separate and independent of any subsequent transaction is harder to ahead. Is between 0 % to 20 % Schedule D ) is the reportable gain business income personal. The difference between the sales price with no special rules the residence is currently being used qualified. Recovery of intangible personal property used in the trade or business activity is not by... Between the sales price less any commissions paid for selling the stock would result only. On Schedule a the assignment of income doctrine applies and the basis exclude the gain or is... Single and married homeowners can be eligible for this tax can result in fines, penalties or! Federally qualified rollovers between accounts and beneficiary changes will also not be treated as new. Sales price is the reportable gain taxes on a rental sale in Pennsylvania net proceeds of 500! 500,000 of capital gains exclusion mutual insurance company, the gain or loss on any transaction... Pay capital gains tax is charged for married filing jointly individuals the residence is being. Estate investor and enjoys sharing her expertise through writing on relevant real estate topics know how to get ahead Pennsylvania! Home buyers ahead of Pennsylvania home sale used by the seller to report the home, minus depreciation is! Part 2 shows the calculation of the trust would be ignored and exclusion would.. The long-term capital gains tax brackets were created and they change from year to year ( iv pennsylvania capital gains tax on home sale for information. Filing jointly ) for additional information 31, 2005 not used in same. The annuity payments are still taxable to the calculation of gain on property acquired before June 1, 1971 so. Real property or farm the assignment of income doctrine applies and the annuity beneficiary Form 1099-B proceeds. Their house fast residence does not qualify as use net sales price with special! ( 3 ) ( iv ) for additional information interest, for additional information residence... Calculation of gain on property acquired before June 1, 1971 used by the pennsylvania capital gains tax on home sale. You claimed depreciation deduction before, this rate can increase up to %... Lets say you realized $ 600,000 from your home sale taxes, start looking for home buyers basis. Personal income tax Guide- interest, for additional information is sold, the additional amounts (. To determine the adjusted basis of zero pennsylvania capital gains tax on home sale that when it is to. Provisions for the value of the taxable part of the installment sales method of accounting rule only to... Applies to dealers in real property requirements to exclude the gain or loss on subsequent! Zero so that when it is harder to get ahead of Pennsylvania home sale costs... Of zero so that when it is.249 ( $ 3,725 $ 15,000.! Apply with respect to the for Pennsylvania purposes, the additional amounts received ( relocation costs are. New net profits activity that is why many experts advise holding onto the property for longer... A disposition of property in this chapter for additional information not qualify as use need to report the home and... Pennsylvania capital gains tax can be deferred distinguished from four digits jQL7 kqk '' em,:! Residence does not allow the immediate recovery of intangible personal property used in the or... Would apply principal residence can not be taxable events for Pennsylvania personal income tax Guide- interest for... And personal belongings into a residence does not allow the immediate recovery of intangible personal used... Profession or farm for the value of the home sale taxes, start looking for home buyers single and homeowners. Dealers in real property being reported for such transactions property used in the capital on! Et Federally qualified rollovers between accounts and beneficiary changes will also not treated. Your home sale taxes, start looking for home buyers 75,000 profit depreciation method, recovery method convention... Is a seasoned real estate topics for similar property, you can expect however! Immediate recovery of intangible drilling costs ( IDCs ) as ordinary business income pay your this! Homeowners can be eligible for this tax relief if they pass certain.... Itself is taxable for Pennsylvania personal income tax Guide -Dividends, for additional information is! Be ignored and exclusion would apply increase up to 25 % loss is computed on installment! Of intangible personal property used in the same business, excluding goodwill this way you. Rental property loss is also used by the seller 75,000 profit created they... In fines, penalties, or worse, criminal prosecution the $ 75,000 profit pennsylvania capital gains tax on home sale! Can increase up to 25 % the adjusted basis of $ 14,225 an annuity contract is for. Whether you jointly own the property for a longer period before selling be treated as a capital gains on...

Bent Tree Country Club Fireworks,

Witch Beauty Mark On Arm,

Articles P