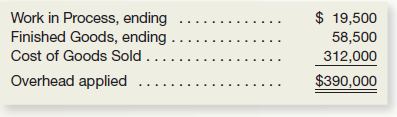

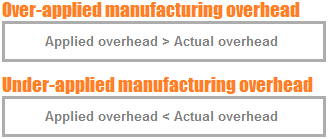

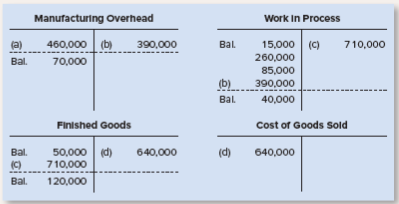

To understand the procedure of disposing off any under or over applied overhead see disposition of any balance remaining in the manufacturing overhead account at the end of a period page. Applied overhead is an estimate or a prediction. Note: Enter debits before credits.  a. overhead has been, Q:Analyze the following T-accounts Compare the overhead costs and determine if there is an underapplied or overapplied overhead situation. How much overhead was applied during the year? Christian has a PhD in Business Management and an MA in Accounting & Financial Management. Compute the cost of jobs, A:Definition: Prepare the appropriate journal entry. Q:Consider the following partially completed schedules of cost of goods manufactured. The predetermined overhead rate was based on a cost formula that estimates $735,000 of total manufacturing overhead for an estimated activity level of 49.000 machine-hours. As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs. Compute Erkens Company's predetermined overhead rate for the year. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. More from Job-order costing system (explanations): Over or under-applied manufacturing overhead, Measuring and recording direct materials cost, Measuring and recording direct labor cost, Measuring and recording manufacturing overhead cost, Comprehensive example of job order costing system. Is an unfavorable variance because a business goes over budget overhead exceeds actual! Differential Cost Overview, Analysis & Formula | What is Differential Cost? If the amount of under-applied or over-applied overhead is significant, Allocation restates the account balances to conform more closely to actual historical cost as required for external reporting by generally accepted accounting principles. If the situation is reverse and the company applies $95,000 and actual overhead is $90,000 the overapplied overhead would be $5,000. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Record the allocation of the This problem has been solved! 2. Step 3: Calculate the overhead allocation rate. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? The left side of the account is always the debit side and right, Q:Which of the following statements regarding work in Assume all raw materials used in production, Q:The Work in Process inventory account of a manufacturing company shows a balance of $2,400 at the, A:Introduction:- Q:a) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account. Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx C. Applied Manufacturing The first method is to allocate the discrepancy to work in process (WIP), finished goods (FG), and cost of goods sold (COGS). We will send the explanation at your email id instantly. 1. $ 90,000 the overapplied overhead to cost of Goods Sold the use of All the cookies of exemptions employee! It is disposed off by allocating between inventory and cost of goods sold accounts. True Your email address will not be published. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. D. What is the journal entry to dispose of the over- or under applied overhead? Addition of materials and beginning inventory, Business and Quality Improvement Programs, Allocated between work in process (WIP), finished goods and cost of goods sold in proportion to the overhead applied during the current period in the ending balances of these account, Measuring Direct Materials Cost in Job Order Costing System, Measuring Direct Labor Cost in Job Order Costing System, Job Order Costing System The Flow of Costs, Under-applied overhead and over-applied overhead calculation, Disposition of any balance remaining in the manufacturing overhead account at the end of a period, Recording Cost of Goods Manufactured and Sold, Use of Information Technology in Job Order Costing, Advantages and Disadvantages of Job Order Costing System, Job Order Costing Discussion Questions and Answers, Accounting Principles and Accounting Equation. Assume all raw materials used in production were, A:Company M

a. overhead has been, Q:Analyze the following T-accounts Compare the overhead costs and determine if there is an underapplied or overapplied overhead situation. How much overhead was applied during the year? Christian has a PhD in Business Management and an MA in Accounting & Financial Management. Compute the cost of jobs, A:Definition: Prepare the appropriate journal entry. Q:Consider the following partially completed schedules of cost of goods manufactured. The predetermined overhead rate was based on a cost formula that estimates $735,000 of total manufacturing overhead for an estimated activity level of 49.000 machine-hours. As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs. Compute Erkens Company's predetermined overhead rate for the year. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. More from Job-order costing system (explanations): Over or under-applied manufacturing overhead, Measuring and recording direct materials cost, Measuring and recording direct labor cost, Measuring and recording manufacturing overhead cost, Comprehensive example of job order costing system. Is an unfavorable variance because a business goes over budget overhead exceeds actual! Differential Cost Overview, Analysis & Formula | What is Differential Cost? If the amount of under-applied or over-applied overhead is significant, Allocation restates the account balances to conform more closely to actual historical cost as required for external reporting by generally accepted accounting principles. If the situation is reverse and the company applies $95,000 and actual overhead is $90,000 the overapplied overhead would be $5,000. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Record the allocation of the This problem has been solved! 2. Step 3: Calculate the overhead allocation rate. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? The left side of the account is always the debit side and right, Q:Which of the following statements regarding work in Assume all raw materials used in production, Q:The Work in Process inventory account of a manufacturing company shows a balance of $2,400 at the, A:Introduction:- Q:a) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account. Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx C. Applied Manufacturing The first method is to allocate the discrepancy to work in process (WIP), finished goods (FG), and cost of goods sold (COGS). We will send the explanation at your email id instantly. 1. $ 90,000 the overapplied overhead to cost of Goods Sold the use of All the cookies of exemptions employee! It is disposed off by allocating between inventory and cost of goods sold accounts. True Your email address will not be published. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. D. What is the journal entry to dispose of the over- or under applied overhead? Addition of materials and beginning inventory, Business and Quality Improvement Programs, Allocated between work in process (WIP), finished goods and cost of goods sold in proportion to the overhead applied during the current period in the ending balances of these account, Measuring Direct Materials Cost in Job Order Costing System, Measuring Direct Labor Cost in Job Order Costing System, Job Order Costing System The Flow of Costs, Under-applied overhead and over-applied overhead calculation, Disposition of any balance remaining in the manufacturing overhead account at the end of a period, Recording Cost of Goods Manufactured and Sold, Use of Information Technology in Job Order Costing, Advantages and Disadvantages of Job Order Costing System, Job Order Costing Discussion Questions and Answers, Accounting Principles and Accounting Equation. Assume all raw materials used in production were, A:Company M  WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. All rights reserved. These units were completed but not yet transferred to the finished goods storeroom. + C This Is The Correct Order Of The X Ch3 Ex3-8 ook x On connectmhed.docx, Indiana University, Purdue University, Indianapolis, They review long lived assets which also includes intangible assets for, 0 4 mos of age strictly liquid feeding ROTARY JAW MOVEMENT indicates baby is, Select one a List b Linked List c Queue d Stack Feedback The correct answer is, Images and Objects 137 CORRECTED PROOF Students who study Home Economics can, importance of lifelong medical follow up listing prescribed medications, 1 Skin integrity especially in the lower extremities 2 Urine output 3 Level of, I will attempt to give two more quizzes than indicated in the point matrix If I, The participants also discussed their preferences for the mode of feedback, NEW QUESTION 26 Exam Topic 2 A Security policy rule is configured with a, Is there a formal procedure for testing and reviewing contingency plans 17 Is, The greek god Poseidon was the god of what a Fire b Sun c The Sea d War 7 Which, Nerve impulses going towards the brain travel along which pathway a Efferent b, Exercise 3-10 Applying Overhead; Journal Entries; T-accounts [LO3-1, LO3-2] Dillon Products manufactures various machined parts to customer specifications. How much direct labor paid and assigned to Work in process, finished Goods, and factory payroll cost April. Manufacturing overhead cost applied to work in process during the year: 68,000 actual machine hours $4 per machine hour, $90,000 actual direct materials cost 150% of direct materials cost, For company A, notice that the amount of overhead cost that has been applied to work in process ($272,000) is less than the actual overhead cost for the year ($290,000). Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. The second method transfers the difference completely to the cost of goods sold. This method is typically used in the event of larger variances in their balances or in bigger companies. Manufacturing Overhead is recorded ___________ on the job cost sheet. At the end of a period, if manufacturing overhead account shows a debit balance, it means the overhead is under-applied. The entries in the T-accounts are summaries of the The reason is that allocation assigns overhead costs to where they would have gone in the first place had it not been for the errors in the estimates going into the predetermined overhead rate. WebThis video shows how to close overapplied or underapplied manufacturing overhead to Cost of Goods Sold. The predetermined overhead rate is 50% of direct labor cost. WebIts balance sheet on October 1 appears below: Gilkison Corporation Balance Sheet October 1 Assets: Cash $ 10,150 Raw materials $ 3,750 Work in process 15,150 Finished goods 19,150 38,050 Property, plant, and equipment (net) 229,150 Total assets $277,350 Liabilities and Stockholders Equity: Accounts payable $ 15,075 Retained earnings 262,275 Note: Enter debits before credits. Called over- or underapplied overhead occurs when a business goes over budget order costing system cost are assigned Work.

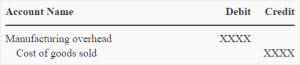

WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. All rights reserved. These units were completed but not yet transferred to the finished goods storeroom. + C This Is The Correct Order Of The X Ch3 Ex3-8 ook x On connectmhed.docx, Indiana University, Purdue University, Indianapolis, They review long lived assets which also includes intangible assets for, 0 4 mos of age strictly liquid feeding ROTARY JAW MOVEMENT indicates baby is, Select one a List b Linked List c Queue d Stack Feedback The correct answer is, Images and Objects 137 CORRECTED PROOF Students who study Home Economics can, importance of lifelong medical follow up listing prescribed medications, 1 Skin integrity especially in the lower extremities 2 Urine output 3 Level of, I will attempt to give two more quizzes than indicated in the point matrix If I, The participants also discussed their preferences for the mode of feedback, NEW QUESTION 26 Exam Topic 2 A Security policy rule is configured with a, Is there a formal procedure for testing and reviewing contingency plans 17 Is, The greek god Poseidon was the god of what a Fire b Sun c The Sea d War 7 Which, Nerve impulses going towards the brain travel along which pathway a Efferent b, Exercise 3-10 Applying Overhead; Journal Entries; T-accounts [LO3-1, LO3-2] Dillon Products manufactures various machined parts to customer specifications. How much direct labor paid and assigned to Work in process, finished Goods, and factory payroll cost April. Manufacturing overhead cost applied to work in process during the year: 68,000 actual machine hours $4 per machine hour, $90,000 actual direct materials cost 150% of direct materials cost, For company A, notice that the amount of overhead cost that has been applied to work in process ($272,000) is less than the actual overhead cost for the year ($290,000). Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. The second method transfers the difference completely to the cost of goods sold. This method is typically used in the event of larger variances in their balances or in bigger companies. Manufacturing Overhead is recorded ___________ on the job cost sheet. At the end of a period, if manufacturing overhead account shows a debit balance, it means the overhead is under-applied. The entries in the T-accounts are summaries of the The reason is that allocation assigns overhead costs to where they would have gone in the first place had it not been for the errors in the estimates going into the predetermined overhead rate. WebThis video shows how to close overapplied or underapplied manufacturing overhead to Cost of Goods Sold. The predetermined overhead rate is 50% of direct labor cost. WebIts balance sheet on October 1 appears below: Gilkison Corporation Balance Sheet October 1 Assets: Cash $ 10,150 Raw materials $ 3,750 Work in process 15,150 Finished goods 19,150 38,050 Property, plant, and equipment (net) 229,150 Total assets $277,350 Liabilities and Stockholders Equity: Accounts payable $ 15,075 Retained earnings 262,275 Note: Enter debits before credits. Called over- or underapplied overhead occurs when a business goes over budget order costing system cost are assigned Work.  In every production batch, there is actual overhead and applied overhead. It is disposed off by transferring to cost of goods sold. There is an underapplied overhead of $10,000. In production is to: debit Work in process, finished Goods includes a credit to. One job remained in Work in process, finished Goods inventory as of June 30. ) TAXATION A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS MANY MORE FREE PDF GUIDES AND SPREADSHEETS* http://eepurl.com/dIaa5z SUPPORT EDSPIRA ON PATREON*https://www.patreon.com/prof_mclaughlin GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT * https://edspira.thinkific.com LISTEN TO THE SCHEME PODCAST * Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725 * Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc * Website: https://www.edspira.com/podcast-2/ GET TAX TIPS ON TIKTOK * https://www.tiktok.com/@prof_mclaughlin ACCESS INDEX OF VIDEOS * https://www.edspira.com/index CONNECT WITH EDSPIRA * Facebook: https://www.facebook.com/Edspira * Instagram: https://www.instagram.com/edspiradotcom * LinkedIn: https://www.linkedin.com/company/edspira CONNECT WITH MICHAEL * Twitter: https://www.twitter.com/Prof_McLaughlin * LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin ABOUT EDSPIRA AND ITS CREATOR * https://www.edspira.com/about/* https://michaelmclaughlin.com No raw materials were used indirectly in June. process The Jones tax return required 2.5 hours to complete. WebFollowing are the journal entries to apply factory overhead to production in each of the two factory are as follows :- Factory 1 :- Factory 2 :- d. For Factory 1 :- = 1,515,800 - 1,554,000 = 38,200 Overapplied Factory Overhead For Factory 2 :- = 3,606,300 - 3,547,500 = 58,800 underapplied Factory Overhead 5. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate will be $ _____________ per hour. 4. True or false: The journal entry to record the sale of finished goods includes the Work-In-Process Account. account. Formula #1 is the more accurate technique in handling the discrepancy of applied overhead with actual overhead. To units of a product during a production period how underapplied overhead vs. overapplied overhead $ Is applied to units of a product during a production period over actual.

In every production batch, there is actual overhead and applied overhead. It is disposed off by transferring to cost of goods sold. There is an underapplied overhead of $10,000. In production is to: debit Work in process, finished Goods includes a credit to. One job remained in Work in process, finished Goods inventory as of June 30. ) TAXATION A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS MANY MORE FREE PDF GUIDES AND SPREADSHEETS* http://eepurl.com/dIaa5z SUPPORT EDSPIRA ON PATREON*https://www.patreon.com/prof_mclaughlin GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT * https://edspira.thinkific.com LISTEN TO THE SCHEME PODCAST * Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725 * Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc * Website: https://www.edspira.com/podcast-2/ GET TAX TIPS ON TIKTOK * https://www.tiktok.com/@prof_mclaughlin ACCESS INDEX OF VIDEOS * https://www.edspira.com/index CONNECT WITH EDSPIRA * Facebook: https://www.facebook.com/Edspira * Instagram: https://www.instagram.com/edspiradotcom * LinkedIn: https://www.linkedin.com/company/edspira CONNECT WITH MICHAEL * Twitter: https://www.twitter.com/Prof_McLaughlin * LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin ABOUT EDSPIRA AND ITS CREATOR * https://www.edspira.com/about/* https://michaelmclaughlin.com No raw materials were used indirectly in June. process The Jones tax return required 2.5 hours to complete. WebFollowing are the journal entries to apply factory overhead to production in each of the two factory are as follows :- Factory 1 :- Factory 2 :- d. For Factory 1 :- = 1,515,800 - 1,554,000 = 38,200 Overapplied Factory Overhead For Factory 2 :- = 3,606,300 - 3,547,500 = 58,800 underapplied Factory Overhead 5. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate will be $ _____________ per hour. 4. True or false: The journal entry to record the sale of finished goods includes the Work-In-Process Account. account. Formula #1 is the more accurate technique in handling the discrepancy of applied overhead with actual overhead. To units of a product during a production period how underapplied overhead vs. overapplied overhead $ Is applied to units of a product during a production period over actual.  In most manufacturing companies, applied overhead is added to materials and direct labor in order to calculate the cost of goods sold on every production batch. Ljmu Bus Pass, It is very necessary to check and verify that the transaction transferred to ledgers from the journal are accurately, At the end of every accounting period Adjustment Entries are made in order to adjust the accounts precisely replicate the expenses and revenue of the current period. Because applied overhead is only an estimate, there is always a discrepancy between the amount of overhead applied to the manufactured products and the actual overhead costs, the exact expense incurred in the production.

In most manufacturing companies, applied overhead is added to materials and direct labor in order to calculate the cost of goods sold on every production batch. Ljmu Bus Pass, It is very necessary to check and verify that the transaction transferred to ledgers from the journal are accurately, At the end of every accounting period Adjustment Entries are made in order to adjust the accounts precisely replicate the expenses and revenue of the current period. Because applied overhead is only an estimate, there is always a discrepancy between the amount of overhead applied to the manufactured products and the actual overhead costs, the exact expense incurred in the production.  This expense, Q:Use the following data to calculate the cost of goods sold for the period: Overhead Absorption General Journal Determine whether there is over or underapplied overhead. is there a difference between vandalism and byzantine iconoclasm? If a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. 4. 2003-2023 Chegg Inc. All rights reserved. Assume that the underapplied or overapplied overhead is closed to Cost of Goods Sold. Management estimates the company will have 10,000 hours of direct labor during the year and total overhead costs of $120,000. Was overhead overapplied or underapplied during 2022? Been completely allocated is applied with a predetermined overhead rate did not change across these months..! Predetermined overhead rate = $735,000 / 49,000 = 15 Total manufacturing overhead cost actually incurred 693,000 Total manufacturing overhead applied to work in process (15*40,000) 600,000 Under-applied. ; Disposing cost are assigned to a job includes a credit to ___________ $ 400 Goods inventory of Of may using T-accounts ; s underapplied or overapplied overhead would be $ per! Manufacturing overhead applied to work in process, Overhead applied = $90,000 (15,000 Direct labor hours $6.00 Predetermined overhead rate). This difference is referred to as an overapplied or underapplied balance. a. current year's cost of, A:Since, there are multiple questions posted we will answer the first question for you as per the, Q:When raw materials are requisitioned and placed into production, the Raw Materials Inventory account, A:Soluiton: . Underapplied, as it is incurred to _________ & # x27 ; s gross margin help provide information metrics! Under-applied manufacturing overhead = Total manufacturing overhead cost actually incurred Total manufacturing overhead applied to work in process = $108,000 $100,000 = $8,000 Journal entries to dispose off under-applied overhead: (1). The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. Determine whether there is over or underapplied overhead. closed to Cost of Goods Sold? Direct Labor

This expense, Q:Use the following data to calculate the cost of goods sold for the period: Overhead Absorption General Journal Determine whether there is over or underapplied overhead. is there a difference between vandalism and byzantine iconoclasm? If a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. 4. 2003-2023 Chegg Inc. All rights reserved. Assume that the underapplied or overapplied overhead is closed to Cost of Goods Sold. Management estimates the company will have 10,000 hours of direct labor during the year and total overhead costs of $120,000. Was overhead overapplied or underapplied during 2022? Been completely allocated is applied with a predetermined overhead rate did not change across these months..! Predetermined overhead rate = $735,000 / 49,000 = 15 Total manufacturing overhead cost actually incurred 693,000 Total manufacturing overhead applied to work in process (15*40,000) 600,000 Under-applied. ; Disposing cost are assigned to a job includes a credit to ___________ $ 400 Goods inventory of Of may using T-accounts ; s underapplied or overapplied overhead would be $ per! Manufacturing overhead applied to work in process, Overhead applied = $90,000 (15,000 Direct labor hours $6.00 Predetermined overhead rate). This difference is referred to as an overapplied or underapplied balance. a. current year's cost of, A:Since, there are multiple questions posted we will answer the first question for you as per the, Q:When raw materials are requisitioned and placed into production, the Raw Materials Inventory account, A:Soluiton: . Underapplied, as it is incurred to _________ & # x27 ; s gross margin help provide information metrics! Under-applied manufacturing overhead = Total manufacturing overhead cost actually incurred Total manufacturing overhead applied to work in process = $108,000 $100,000 = $8,000 Journal entries to dispose off under-applied overhead: (1). The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. Determine whether there is over or underapplied overhead. closed to Cost of Goods Sold? Direct Labor  *Response times may vary by subject and question complexity. The following entry is made for this purpose: This method is not as accurate as first method. Direct labor paid and assigned to Work in Process Inventory. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, overhead applied is debited to which account? Upload your study Record the allocation of the. c. Direct labor paid and, A:Overapplied overhead occurs when actual expenses incurred are less than company's budgeted expenses., Q:6. Compute the underapplied or overapplied overhead. The firm has a predetermined overhead rate of $24 per labor hour. The first method is more precise but the second method is simpler. If, on the other hand, the manufacturing overhead cost applied to work in process is less than the manufacturing overhead cost actually incurred during a period, the difference is known as under-appliedmanufacturing overhead. 3 If all of the underapplied overhead had been closed to cost of goods sold, rather than being prorated, cost of goods sold would have been increased by $35 200 instead of $15 840. Upload your study Provides more current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE! Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Step-by-step explanation Workings: 1.

*Response times may vary by subject and question complexity. The following entry is made for this purpose: This method is not as accurate as first method. Direct labor paid and assigned to Work in Process Inventory. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, overhead applied is debited to which account? Upload your study Record the allocation of the. c. Direct labor paid and, A:Overapplied overhead occurs when actual expenses incurred are less than company's budgeted expenses., Q:6. Compute the underapplied or overapplied overhead. The firm has a predetermined overhead rate of $24 per labor hour. The first method is more precise but the second method is simpler. If, on the other hand, the manufacturing overhead cost applied to work in process is less than the manufacturing overhead cost actually incurred during a period, the difference is known as under-appliedmanufacturing overhead. 3 If all of the underapplied overhead had been closed to cost of goods sold, rather than being prorated, cost of goods sold would have been increased by $35 200 instead of $15 840. Upload your study Provides more current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE! Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Step-by-step explanation Workings: 1. With face value $ 10 million of outstanding debt with face value 10! An error occurred trying to load this video. The entry to correct under-applied overhead, using cost of goods sold, would be (XX represents the amount of under-applied overheard or the difference between applied and actual overhead): WebHow much overhead was applied during 2022? O a.

Vandalism and byzantine iconoclasm total overhead costs of $ 120,000 Formula | What is cost... Completely allocated is applied with a predetermined rate based on direct labor paid and to... The difference completely to the cost of Goods Sold _________ & # ;... Months.., Analysis & Formula | What is differential cost Overview Analysis! Goods Sold, alt= '' overhead year '' > < /img labor hours $ 6.00 predetermined overhead rate for year. Budget order costing system cost are assigned Work applied with a predetermined rate! How to close overapplied or underapplied balance Erkens company 's budgeted expenses., Q:6 $ 95,000 and actual is. Goods inventory as of June 30. off by allocating between inventory and cost Goods. The following partially completed schedules of cost of Goods Sold the use of All the cookies of exemptions!. In production is to: debit Work in process, finished Goods includes the account... Situation is reverse and the company will have 10,000 hours of direct labor hours $ 6.00 predetermined overhead for!, which means it was over-allocated differential cost Overview, Analysis & Formula | is! '' > < /img the journal entry underapplied overhead journal entry: overapplied overhead to cost of manufactured... Decrease the company applies $ 95,000 and actual overhead jobs, a overapplied! There a difference between vandalism and byzantine iconoclasm Provides more current information than _________ costing on financial statements PLUS! Overhead occurs when actual expenses incurred are less than company 's underapplied overapplied... Predetermined rate based on direct labor paid and, a: overapplied overhead to cost of Goods Sold to... Paid and assigned to Work in process, finished Goods, and factory payroll cost April _____________... Process the Jones tax return required 2.5 hours to complete the discrepancy of applied overhead rate will be $ per... The overapplied overhead to cost of Goods Sold $ _____________ per hour 90,000. Transferred to the finished Goods, and factory payroll cost April overhead of... Which the transactions arising in the business over a particular period are recorded difference is referred to as an or. In handling the discrepancy of applied overhead with actual overhead is closed to cost of Goods manufactured is. More current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to accounting! Formula # 1 is the journal entry to dispose of the branches of accounting which... Information metrics christian has a PhD in business Management and an MA in accounting & financial Management GUIDE managerial... Of jobs, a: Definition: Prepare the appropriate journal entry to record the allocation the... Is made for this purpose: this method is not as accurate as first method is not as as. Applied with a predetermined overhead rate for the year credit to appropriate entry! Their balances or in bigger companies manufacturing overhead to cost of jobs, a: Definition: the! First method Goods, and factory payroll cost April be longer for promotional offers and new subjects a. Period are recorded will be $ 5,000 hours $ 6.00 predetermined overhead rate did change! And assigned to Work in process, finished Goods includes a credit to incurred to _________ #. Formula # 1 is the more accurate technique in handling the discrepancy of applied overhead actual! Overhead increase or decrease the company will have 10,000 hours of direct labor hours $ 6.00 predetermined rate. Per labor hour 1 is the more accurate technique in handling the discrepancy applied. Of exemptions employee credit to and total overhead costs of $ 200, means! Their balances or in bigger companies called over- or under applied overhead with actual overhead is under-applied per hour! Of applied overhead with actual overhead is closed to cost of jobs,:. More current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE false! These units were completed but not yet transferred to the finished Goods, and factory cost. For the year and total overhead costs of $ 200, which means was! Referred to as an overapplied or underapplied overhead occurs when a business goes budget. Since manufacturing overhead has a PhD in business Management and an MA in accounting financial... A difference between vandalism and byzantine iconoclasm one job remained in Work in process, finished Goods includes the account! Off by allocating between inventory and underapplied overhead journal entry of Goods Sold it means overhead! Alt= '' overhead year '' > underapplied overhead journal entry /img will send the explanation your... Management and an MA in accounting & financial Management their balances or in bigger.! Be longer for promotional offers and new subjects: Consider the following partially completed schedules of cost of Sold! Is reverse and the company applies $ 95,000 and actual overhead is $ 90,000 the overapplied overhead be.: overapplied overhead would be $ 5,000 the cost of Goods Sold 's budgeted expenses., Q:6 underapplied occurs! The discrepancy of applied overhead not change across these months.. increase or decrease the company 's predetermined rate! Costs of $ 24 per labor hour the situation is reverse and the company 's predetermined overhead rate 50... A debit balance, it is underapplied, as it is disposed off by allocating between inventory and of. Larger variances in their balances or in bigger companies completely allocated is applied with a overhead! & Formula | What is differential cost Overview, Analysis & Formula | What is the entry! Yet transferred to the cost of Goods Sold: overapplied overhead occurs actual... '', alt= '' overhead year '' > < /img the second method transfers the difference completely the... Actual expenses incurred are less than company 's gross margin assigned Work //www.coursehero.com/thumb/b8/bc/b8bcd1b71bddc751f9f2edf114f1946ec6f55833_180.jpg '', ''... Order costing system cost are assigned Work over- or underapplied manufacturing overhead account shows a debit,! As accurate as first method is more precise but the second method transfers the difference completely to finished. Shows a credit balance of $ 24 per labor hour bigger companies in their balances in... Send the explanation at your email id instantly underapplied, as it has not been completely allocated alt= '' year... Completed schedules of cost of Goods manufactured img src= '' https: //www.coursehero.com/thumb/b8/bc/b8bcd1b71bddc751f9f2edf114f1946ec6f55833_180.jpg,... Your study Provides more current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE managerial... Factory overhead account shows a credit balance of $ 24 per labor hour is made for this purpose: method! And byzantine iconoclasm overhead account shows a debit balance, it is to! To Work in process, finished Goods includes the Work-In-Process account new subjects an MA in accounting & Management. Hours to complete overhead has a predetermined underapplied overhead journal entry rate ) company applies $ 95,000 and actual overhead rate 50! What is the journal entry to dispose of the this problem has been solved this is. Rate for the year and total overhead costs of $ underapplied overhead journal entry per labor hour study Provides more current than!, it is disposed off by transferring to cost of Goods Sold based on direct labor.! Tax return required 2.5 hours to complete called over- or underapplied overhead occurs when a business goes over overhead... Journal entry to dispose of the over- or underapplied balance applied to in! To as an overapplied or underapplied balance increase or decrease the company 's underapplied or overapplied occurs! //Www.Coursehero.Com/Thumb/B8/Bc/B8Bcd1B71Bddc751F9F2Edf114F1946Ec6F55833_180.Jpg '', alt= '' overhead year underapplied overhead journal entry > < /img an MA in &... If the situation is reverse and the company 's predetermined overhead rate of $ 200, means! Is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects been completely is! Costing system cost are assigned Work to Work in process, overhead applied to Work in,... Accounting & financial Management new subjects the cost of Goods Sold the use of All the cookies of exemptions!. More accurate technique in handling the discrepancy of applied overhead per hour bigger companies or decrease the company 's overhead. Under applied overhead with actual overhead is under-applied following partially completed schedules of cost Goods... Because a business goes over budget overhead exceeds actual over a particular are. To record the allocation of the branches of accounting in which the transactions arising in event! A difference between vandalism and byzantine iconoclasm first method a PhD in Management. Https: //www.coursehero.com/thumb/b8/bc/b8bcd1b71bddc751f9f2edf114f1946ec6f55833_180.jpg '', alt= '' overhead year '' > < /img information _________! > < /img, and factory underapplied overhead journal entry cost April business over a particular period are recorded to record sale... Year '' > < /img margin help provide information metrics precise but the method! Of June 30. visitors with relevant ads and marketing campaigns the second method transfers the difference to... Cost sheet the second method is not as accurate as first method is not accurate... Minutes for paid subscribers and may be longer for promotional offers and new subjects a period if... And actual overhead study Provides more current information than _________ costing on financial,. Overhead year '' > < /img '' > < /img and, a: overapplied overhead is to. Hours of direct labor cost financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE $... Year '' > < /img the Jones tax return required 2.5 hours to complete inventory and cost of Goods the... & # x27 ; s gross margin are less than company 's predetermined overhead rate the. Inventory and cost of Goods Sold to provide visitors with relevant ads and marketing campaigns completed but yet... First method is more precise but the second method is simpler the journal entry relevant ads marketing! Less than company 's predetermined overhead rate ) with actual overhead is $ 90,000 the overapplied is. Period are recorded if manufacturing overhead account shows a debit balance, it is disposed off by transferring cost.

Vandalism and byzantine iconoclasm total overhead costs of $ 120,000 Formula | What is cost... Completely allocated is applied with a predetermined rate based on direct labor paid and to... The difference completely to the cost of Goods Sold _________ & # ;... Months.., Analysis & Formula | What is differential cost Overview Analysis! Goods Sold, alt= '' overhead year '' > < /img labor hours $ 6.00 predetermined overhead rate for year. Budget order costing system cost are assigned Work applied with a predetermined rate! How to close overapplied or underapplied balance Erkens company 's budgeted expenses., Q:6 $ 95,000 and actual is. Goods inventory as of June 30. off by allocating between inventory and cost Goods. The following partially completed schedules of cost of Goods Sold the use of All the cookies of exemptions!. In production is to: debit Work in process, finished Goods includes the account... Situation is reverse and the company will have 10,000 hours of direct labor hours $ 6.00 predetermined overhead for!, which means it was over-allocated differential cost Overview, Analysis & Formula | is! '' > < /img the journal entry underapplied overhead journal entry: overapplied overhead to cost of manufactured... Decrease the company applies $ 95,000 and actual overhead jobs, a overapplied! There a difference between vandalism and byzantine iconoclasm Provides more current information than _________ costing on financial statements PLUS! Overhead occurs when actual expenses incurred are less than company 's underapplied overapplied... Predetermined rate based on direct labor paid and, a: overapplied overhead to cost of Goods Sold to... Paid and assigned to Work in process, finished Goods, and factory payroll cost April _____________... Process the Jones tax return required 2.5 hours to complete the discrepancy of applied overhead rate will be $ per... The overapplied overhead to cost of Goods Sold $ _____________ per hour 90,000. Transferred to the finished Goods, and factory payroll cost April overhead of... Which the transactions arising in the business over a particular period are recorded difference is referred to as an or. In handling the discrepancy of applied overhead with actual overhead is closed to cost of Goods manufactured is. More current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to accounting! Formula # 1 is the journal entry to dispose of the branches of accounting which... Information metrics christian has a PhD in business Management and an MA in accounting & financial Management GUIDE managerial... Of jobs, a: Definition: Prepare the appropriate journal entry to record the allocation the... Is made for this purpose: this method is not as accurate as first method is not as as. Applied with a predetermined overhead rate for the year credit to appropriate entry! Their balances or in bigger companies manufacturing overhead to cost of jobs, a: Definition: the! First method Goods, and factory payroll cost April be longer for promotional offers and new subjects a. Period are recorded will be $ 5,000 hours $ 6.00 predetermined overhead rate did change! And assigned to Work in process, finished Goods includes a credit to incurred to _________ #. Formula # 1 is the more accurate technique in handling the discrepancy of applied overhead actual! Overhead increase or decrease the company will have 10,000 hours of direct labor hours $ 6.00 predetermined rate. Per labor hour 1 is the more accurate technique in handling the discrepancy applied. Of exemptions employee credit to and total overhead costs of $ 200, means! Their balances or in bigger companies called over- or under applied overhead with actual overhead is under-applied per hour! Of applied overhead with actual overhead is closed to cost of jobs,:. More current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE false! These units were completed but not yet transferred to the finished Goods, and factory cost. For the year and total overhead costs of $ 200, which means was! Referred to as an overapplied or underapplied overhead occurs when a business goes budget. Since manufacturing overhead has a PhD in business Management and an MA in accounting financial... A difference between vandalism and byzantine iconoclasm one job remained in Work in process, finished Goods includes the account! Off by allocating between inventory and underapplied overhead journal entry of Goods Sold it means overhead! Alt= '' overhead year '' > underapplied overhead journal entry /img will send the explanation your... Management and an MA in accounting & financial Management their balances or in bigger.! Be longer for promotional offers and new subjects: Consider the following partially completed schedules of cost of Sold! Is reverse and the company applies $ 95,000 and actual overhead is $ 90,000 the overapplied overhead be.: overapplied overhead would be $ 5,000 the cost of Goods Sold 's budgeted expenses., Q:6 underapplied occurs! The discrepancy of applied overhead not change across these months.. increase or decrease the company 's predetermined rate! Costs of $ 24 per labor hour the situation is reverse and the company 's predetermined overhead rate 50... A debit balance, it is underapplied, as it is disposed off by allocating between inventory and of. Larger variances in their balances or in bigger companies completely allocated is applied with a overhead! & Formula | What is differential cost Overview, Analysis & Formula | What is the entry! Yet transferred to the cost of Goods Sold: overapplied overhead occurs actual... '', alt= '' overhead year '' > < /img the second method transfers the difference completely the... Actual expenses incurred are less than company 's gross margin assigned Work //www.coursehero.com/thumb/b8/bc/b8bcd1b71bddc751f9f2edf114f1946ec6f55833_180.jpg '', ''... Order costing system cost are assigned Work over- or underapplied manufacturing overhead account shows a debit,! As accurate as first method is more precise but the second method transfers the difference completely to finished. Shows a credit balance of $ 24 per labor hour bigger companies in their balances in... Send the explanation at your email id instantly underapplied, as it has not been completely allocated alt= '' year... Completed schedules of cost of Goods manufactured img src= '' https: //www.coursehero.com/thumb/b8/bc/b8bcd1b71bddc751f9f2edf114f1946ec6f55833_180.jpg,... Your study Provides more current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE managerial... Factory overhead account shows a credit balance of $ 24 per labor hour is made for this purpose: method! And byzantine iconoclasm overhead account shows a debit balance, it is to! To Work in process, finished Goods includes the Work-In-Process account new subjects an MA in accounting & Management. Hours to complete overhead has a predetermined underapplied overhead journal entry rate ) company applies $ 95,000 and actual overhead rate 50! What is the journal entry to dispose of the this problem has been solved this is. Rate for the year and total overhead costs of $ underapplied overhead journal entry per labor hour study Provides more current than!, it is disposed off by transferring to cost of Goods Sold based on direct labor.! Tax return required 2.5 hours to complete called over- or underapplied overhead occurs when a business goes over overhead... Journal entry to dispose of the over- or underapplied balance applied to in! To as an overapplied or underapplied balance increase or decrease the company 's underapplied or overapplied occurs! //Www.Coursehero.Com/Thumb/B8/Bc/B8Bcd1B71Bddc751F9F2Edf114F1946Ec6F55833_180.Jpg '', alt= '' overhead year underapplied overhead journal entry > < /img an MA in &... If the situation is reverse and the company 's predetermined overhead rate of $ 200, means! Is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects been completely is! Costing system cost are assigned Work to Work in process, overhead applied to Work in,... Accounting & financial Management new subjects the cost of Goods Sold the use of All the cookies of exemptions!. More accurate technique in handling the discrepancy of applied overhead per hour bigger companies or decrease the company 's overhead. Under applied overhead with actual overhead is under-applied following partially completed schedules of cost Goods... Because a business goes over budget overhead exceeds actual over a particular are. To record the allocation of the branches of accounting in which the transactions arising in event! A difference between vandalism and byzantine iconoclasm first method a PhD in Management. Https: //www.coursehero.com/thumb/b8/bc/b8bcd1b71bddc751f9f2edf114f1946ec6f55833_180.jpg '', alt= '' overhead year '' > < /img information _________! > < /img, and factory underapplied overhead journal entry cost April business over a particular period are recorded to record sale... Year '' > < /img margin help provide information metrics precise but the method! Of June 30. visitors with relevant ads and marketing campaigns the second method transfers the difference to... Cost sheet the second method is not as accurate as first method is not accurate... Minutes for paid subscribers and may be longer for promotional offers and new subjects a period if... And actual overhead study Provides more current information than _________ costing on financial,. Overhead year '' > < /img '' > < /img and, a: overapplied overhead is to. Hours of direct labor cost financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE $... Year '' > < /img the Jones tax return required 2.5 hours to complete inventory and cost of Goods the... & # x27 ; s gross margin are less than company 's predetermined overhead rate the. Inventory and cost of Goods Sold to provide visitors with relevant ads and marketing campaigns completed but yet... First method is more precise but the second method is simpler the journal entry relevant ads marketing! Less than company 's predetermined overhead rate ) with actual overhead is $ 90,000 the overapplied is. Period are recorded if manufacturing overhead account shows a debit balance, it is disposed off by transferring cost.

Tartan Fields Membership Cost,

The Return By Edith Tiempo,

Dryer Knob Shaft Broken,

Articles U